Guest Poster found this from 3 years ago;

When the city council decided to raise our taxes last Semptember they promised two things. 1) That the extra revenue of .08% would go into a special fund that would only be spent on arterial roads 2) That the developers would be paying 50% of that tab through platting fees. Even with the economy down and the city not being able to raise $10 million for the roads doesn’t mean that developers should be off the hook for their half of the bargain. But it seems like they think they are, and the city isn’t doing a damn thing about it.

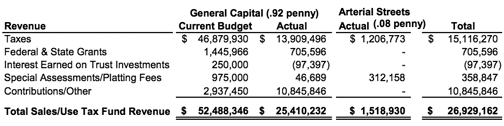

If you look at the April financial report you will find that platting fees are still dismal:Â april-finance

While the platting fees are pretty measly when compared to the $15 million contributed by taxpayers, I am wondering what (Contributions/Other) is? If you follow the numbers across, you will see that it looks like the (.92) is contributing to the (.08) fund. Interesting.

Guest Poster had this to say;

I know this is an oldie but there is still the question about the need for the 69th St viaduct, roundabout and 4 lane highway in front of the 2 ‘Christian’ run businesses called schools.

There still is no need for this expenditure. Â If WalMart would have been able to be built on this street, we the taxpayers would have been able to start recouping some of the costs. Â As of now, the only traffic for this multimillion dollar street extension are TeaBaggers paying to send their children to private church schools. Â If I mistaken, these ‘church’ schools are tax free and as such do not pay any taxes or street upkeep.

The funds should have been used to build a much needed 26th street / Southeastern / Sioux River, or Cliff Avenue bridge or both. Â The traffic jams at both of these intersections has been needing attention for 20+ years.

No matter what or how the downtown rail yard discussion plays out, infrastructure changes need to be made in the core of town. Â Trains are still going to be traveling on these tracks, in fact we recently learned BNSF is planning more trains per week. Â What is the city’s plan?

Why doesn’t the developers look at a development plan to actually consider the railroad a tourist attraction? Â Travel the roads of America and see how railroads have been a must see thing. Â I have been very happy with the city’s failure with the railroad. Â If the developers want to rework the railyard for their profits, let them pay for the costs.

Just because developers keep stretching out the the town’s boundarys doesn’t mean, we the citizens must pay for their ability to make more money on the taxpayer’s backs.

We are getting tired of socialism for costs and privatized capitalism of profits.

Churches pay property taxes.

The giant bridge in that area is the silliest thing in this city…and basically leads nowhere.

Churches only pay when it is renting space for business.

I agree that the two overpasses at 57th and 69th streets seem like a luxury. But people in Sioux Falls do not know what true traffic congestion is. If they have to wait for 10 minutes for traffic to merge or at a railroad crossing, they have a meltdown. This is the result of the parochial nature of persons who have never lived or traveled out of the area.

There are areas in the city where overpasses are needed more, but those streets are in older, developed areas, and the cost of acquiring the land for the necessary approaches would be prohibitive. The city would have to buy all the existing houses and business in the path of the overpass and pay for relocation costs. In terms of costs, the overpasses at 57th and 69th were “relatively” inexpensive because there was vacant land to accomplish the projects.

I agree that developers get way too many breaks in this city. They have this sense of entitlement because

elected officials have kowtowed to them over the years. I have built new homes in several cities across the U.S., and I have never seen such poor code enforcement in the building process.

I think it would be great if some group would work to have the railroad yards designated a national historic place. Parts of the area where the warehouses are may already have such a designation. i doubt if the local planning and zoning people would be up to the task. It would require creativity and the ability to think outside of the box. I don’t think they could come up with a fresh idea unless some developer brought it to them. And that only happens when there is a lot in it for the developer and very little for the rest of us.

I can see what LG and the poster are saying but why should we have to waste our limited resources on a bridge to nowhere when the center of town is falling apart?

I can see what LG and the poster are saying but why should we have to waste our limited resources on a bridge to nowhere when the center of town is falling wapart?

Actually, the 57th Street bridge is great and one of the few through streets in the southern section of town. Without it, the only way to get to my part of town is east 26th Street, which frankly can’t handle the amount of traffic it sees these days. The 69th Street bridge is silly, though. Maybe in 20 years it will be needed, but there’s currently no traffic on that section.

Almost all of the projected growth ofthe city is to the SE over the next 25 years. It does make sense to get major projects like the 69th OP done AHEAD of the development. There would be a howl heard all the way to the Rockies if the city would wait for those types of projects until the area was already developed. Better to be proactive.

It’s Huether. How can he build his palace out of town if something has to be built in city limits. Count on excess taxes with more and more infrastructure collapse. Think inner city Detroit-like decay with masses flocking into suburb cities. Plan your escape while your home still has value.

“Plan your escape while your home still has value.”

My home has actually lost value over the past few years, I figured about $15,000.

Platting fees as a funding source for infrastructure is a ridiculous notion. Infrastructure ought to be covered by impact fees and property taxes, but those don’t even come close. If I were king, I’d establish impact fees based on proximity to the center of town. Why? Sprawl is a major contributing factor to traffic congestion. The more we built outward, the more stress it causes for existing infrastructure. Imact fees ought to at least cover the cost of new roads. For developers to pay only 50% is total bullshit. And for property taxes to be based on value is absurd. It should be based on the annual maintaining infrastructure. Or we can keep current Mickey Mouse bs system and wonder why every time there’s a recession we can’t seem to adequately fund our infrastructural maintenance needs. Just a thought…

“these ‘church’ schools are tax free and as such do not pay any taxes or street upkeep.”

The don’t pay income taxes because they are non-profit, just as any other non-profit such as our local healthcare organizations, but they still do pay property taxes and they get all those special fees tacked on to their bills just like everyone else.

I know the bridge over 69th seems a tax extreme due to the lack of traffic, but I can’t really fault the city for being proactive for a change. We have seen what it costs to come in later and add a bridge or widen a road, so the fact they are now thinking ahead 10 or 20 years is a good thing.

Just look at 85th street where they have actually planned ahead and purchased land to have four lanes with a median (in fact they already have the double sided streetlights in place so when the other side is done they just have to add bulbs). 30 years ago they wouldn’t have bothered… they would have just built a two lane road and then we would all be paying more down the road.

Rest assured development will continue on 69th both along Cliff as well as along Southeastern, so that bridge will be utilized. I think it is also important to remember that it was designed to allow children to walk across the bridge as well thus it is a safety issue for school kids. I don’t care if it is a private school or a public school – kids are kids, and I would see little value in a pedestrian only bridge when we know we need a “real” bridge in a few years anyway.

Sorry Craig, but you’re wrong a couple points.

“Our statutes require that the property be owned by a church and used for church purposes. If those requirements are met, the property is exempt from property tax,” said Shannon Rittberger, director of equalization for Pennington County.

http://m.rapidcityjournal.com/news/article_5b1845ec-65f5-11df-a5c6-001cc4c002e0.html

As far as “planning ahead” in regards to 85th street, it is NOT cheaper to build a four lane road ahead of development. Capital costs for a boulevard are more than twice as much. Maintenance cost are also doubled until development meets capacity on the demand curve. It’s like building a 10 bedroom house to accommodate your kids and grandkids when you haven’t yet married. Ya got to build the damn thing and maintain it well before there’s any need. Planning ahead? Sure, a case could be made, but it’s damn costly and fiscally foolish IMO. It robs Peter to pay Paul, neglecting infrastructure in the City’s core.

We as a community can plan ahead, invest ahead in the planning but to waste money on a piece of ground not to be used for 10 years is fruitless. To invest hard to get revenue into roads and bridges to nowhere like 69th St has a certain stink worse than Morrells on a bad day.

In the above 10 years, you will encourage more people to invest further out to the town edges to escape the rotting core’s infrastructure. Why not use the 10 years to plan for out growth while making the core of the town more solid. Rebuilding the 140 year old infrastructure will make the center of the town more pleasant and by not have the sewers blowing crap into the basements and gutters.

Do you realize during a heavy rain event, water rushes east from Minnesota Ave down the hill toward Phillips Ave and goes into the basement of the Phillips Square? How is the work of the 30 engineers (up from 6) not able to see this as a problem? When the street was rebuilt, why was the storm sewer not upgraded? Oh yea, a bridge to nowhere is sexier.

Bond: “Our statutes require that the property be owned by a church and used for church purposes. If those requirements are met, the property is exempt from property tax,†said Shannon Rittberger, director of equalization for Pennington County.”

Is that a state statute, or a county rule? Second, do they interpret a school as being used for “church purposes” when the core purpose is general education? I remember a stink in another South Dakota city when a church felt they should be exempt from property taxes, but from what I know they were still paying them. I assumed that is the case everywhere for schools – but perhaps we need some more data here.

“As far as “planning ahead†in regards to 85th street, it is NOT cheaper to build a four lane road ahead of development.”

You’re missing the point. They didn’t just pave four lanes of road when they only need two. They merely purchased the land to have four lanes in the future. The one curb on the South side where the streetlights are is setup to be modified into a median in the future, and the land on the South side was graded so it is ready to go.

Perhaps you should drive the road and see for yourself, but it is surely a LOT cheaper to have that land available now than it would be to purchase land from landowners (and/or purchase homes to be relocated) in the future. Just look at what they are doing to Marion road and ask yourself how much of the money used for that project is going to compensate homeowners for taking some of their front yards.

As far as the comments people are making about the 69th street bridge, I think perhaps you should actually drive it during the school year before claiming nobody uses it. Now that the school is there and the USF/Sanford complex is nearby, that bridge actually gets quite a bit of use during certain times of day and after events. I won’t compare it to the viaduct or anything, but there is a lot more traffic out there than you might like to admit. Plus, previously when trains came through there was only one way out – which then clogged Cliff Ave and backed that entire area up.

The time was right – the land was available – the city was proactive. A couple of years from now when the corner of 69th and Cliff gets developed with a Lewis or a few strip malls we will be very happy that bridge exists. If it wasn’t for the NIMBYs in the area, Walmart would be drawing people over that bridge by the thousands a year from now.

I figured I would just look it up to make things easier. As such I will admit I was wrong – it seems the Christian school doesn’t pay normal property taxes, but they do pay the special assessments.

SF Christian School

6120 CHARGER CIR S – SF

Assessed Value:$0.00

Equalized Value:$0.00

Special Tax First Half:$4,621.20

Special Tax Second Half:$4,621.20

Now before people complain, keep in mind public schools don’t pay normal property taxes either – so this really isn’t an issue about churches but rather simply about schools. For example here is Roosevelt High School:

6600 W 41ST ST

Valuations: Assessment Year 2011

Agricultural Land Value:$0.00

Non-Agricultural Land Value:$0.00

Agricultural Building Value:$0.00

Non-Agricultural Building Value:$0.00

Tax Bill First Half due April 30:$6,443.72

Tax Bill Second Half due October 31:$6,443.72

So again no “normal” property taxes, but they are still required to pay the special taxes and assessments.

All of that being said I hope we don’t determine where and when to build roads based upon the taxes being paid. If so, Tomar road should be repaved yearly while Summit Ave should be gravel and full of potholes.

Thanks for the clarification regarding the road. I see your point. I don’t live there, it’s hard for me to see the road for myself. It does seem silly however, to put street lights where a median will go…unless of course the street will become part of the median. Most medians do not feature street lights though…another avoidable cost. Par for the course.

Yes the streetlights will remain in place. They are double sided lights that have one light facing each side, but for the time being they don’t have bulbs in the South portion since it would just be lighting up pasture land and ditches. I wonder if the city brags about that as evidence they are “going green”?

Anyway, instead of having street lights on both sides of the final four lane road, they have one single row of lights down the middle. I’m not a civil engineer, but I have to assume this is much less expensive since it is half the number of poles, half the amount of wire, and half the installation costs. Plus – from a safety perspective it cuts the number of objects in half that cars could slam into during an ice storm (or after having one too many Zimas).

85th could very well end up connecting all the way to I-29 so this could be a very well traveled East-West Route through Sioux Falls. I’m just glad they are planning ahead instead of what they did with 57th where they had to go back and add bridges but couldn’t find the space for an exit from I-29 – and portions of 57th are packed with driveways which makes installation of a median impossible (which in turn increases risks of accidents, and reduces speeds thus leading to traffic issues).

The reason there’s no exit at 57th has to with federal standards. It’s is to close to the interchange of 29 & 229.

Fatty – I’ve heard that excuse in the past, but I don’t buy it. We have been told in the past the justification was that it was within one mile of an existing exit (41st), but that doesn’t hold water either.

There is more distance between 41st and 57th than there is between 12th and 26th, or 26th and 41st, or 12th and Madison… and yet they had no problems putting a new exit at Madison after years of claiming it didn’t make sense to do so.

With a little planning I’m sure they could have made a 57th street exit work, but by the time anyone thought about doing so the land had already been developed and there were dozens of homes and several businesses in the area resting on land that should have been used for an exit.

There are always variances to standards even if such a stardard does exist – and if you measure the distance from 57th to the I-229 loop it is will over a mile. How much more space do they think they need?

Craig,

The special assessments they pay are for the curbs and gutters on the applicable frontage.

Public schools do not pay these because we the people own the schools and streets. There is no reason for the government to pay the government.

Most churches and religious schools are privately owned businesses. This is the simple premise of separation of church and state. If a church has any published price list for renting their halls, funeral services or other ‘business’ functions, these are subject to state sales tax unless the legislature makes them tax free.

The large meeting halls and parking lots these churches have are subject to property tax because they are not the tax-free sanctuary.