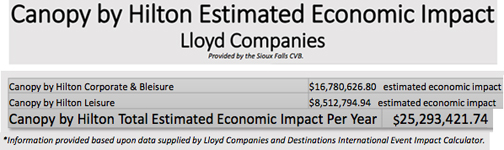

While I have no reason to argue with the data (maybe a little), what they left out of their presentation this afternoon at the informational meeting was that the supposed $25 million dollar a year economic impact doesn’t come from the owners of the development, it comes from their customers, whether local or visitors. They also left out that a large amount of this ‘economic impact’ goes straight into their pockets. So really, what is the justification of the TIF and BID Tax rebates?

When you build a ‘for profit’ business in a capitalist society, you expect to make a profit. Why should you be also rewarded tax breaks? I would think a ‘for profit’ private business that is expecting to have a $25 million dollar impact a year, wouldn’t need any handouts, breaks or rebates. I would think they would be smiling all the way to the bank and simply thanking the city for issuing the permits.

When I look at TIFs I always ask the same question, “What is the benefit to the public as a whole, you know, the ones who have to pay higher property taxes to supplement this TIF?” While I appreciate the study, the only thing it shows me is the money that it will be generating will mostly be helping them.

I would be willing to still give a BID and TIF to the development, but only for the benefit of the city. As I have suggested in the past, I think the city should gift them Kiwanis Park and grant them a TIF for the amount it would take to redevelop that part of the project and forgo the additional $10 million it is supposed to cost taxpayers to redevelop the river greenway, which really makes this a $32.6 million dollar tax break when you add it all together.

I think the city council should amend this TIF, make it a lot smaller and reduce the TIF time limit to 5 years.

After hearing the council tonight discuss the TIF, I have no doubt this will pass. And hey, if you want to support corporate welfare based on a study the developer produced (not the public) so be it, but at least ask for a study that shows the REAL benefit to the rest of us in this community who are paying 100% of their property taxes and always have. You know why they will never produce such a study? Because they won’t like the results.

You also have to take into account, the study they did on economic impact is a ‘prediction’. The study I have asked for is of our current TIFs and what benefit we are getting from them. This would give us REAL data to base their prediction on. Government should never base a 20 year, multi-million dollar tax break on ‘predictions’ of what could happen, but should base them on actual data that already exists. Will they have to courage to ask for it? Probably not.

Wouldn’t the information you’re talking about be based on conjecture just the same because you would have to assume what would have happened but for the TIF? We can measure property taxes and look at increases in other taxes but nonetheless we are making assumptions on what would have been. From a subjective standpoint, we can all agree that downtown is improved from what it was 20 years ago.

how are they figuring this “impact”? at 200 rooms, that would need to be an “impact” of $342 a room, per day every day of the year.

i found this article regarding visitors, and “economic impact”. the numbers are for 2015, but they sure don’t add up to 25 million from one hotel.

“More than 1.9 million visitors came to Sioux Falls in 2015, bringing with them an estimated economic impact of $5.95 million according to a Destination Marketing Association International calculator.

“Sioux Falls has been very fortunate with the growth that we have had.â€

Teri Schmidt, Sioux Falls Convention and Visitors Bureau

Teri Schmidt, executive director of the Sioux Falls Convention and Visitors Bureau, said she expects the city to match that total in in 2017.”

https://www.argusleader.com/story/news/city/2016/08/14/sioux-falls-hotels-project-hotel-tax-revenue-slow/87448216/?fbclid=IwAR325aFYM_vUL4u5KvfnBKDxXl49TKJfhWpLaHq5lAWf8XFEJgL7VlkhO3I

“From a subjective standpoint, we can all agree that downtown is improved from what it was 20 years ago.”

Sure. And in that same time period (I own a home DT) my property taxes have tripled. There is a ‘price’ for progress, and I have paid it, why can’t the private developer contribute also?

The growing inverse relationship between income and property taxes in this town will eventually have all of us living in studio apartments here.

For years, many were worried about a big white FEMA relocation building in this town, but what people should really be worried about is the Gosplan goal to have all of us living in Soviet style apartments here – built by greedy developers – and not in our lovely little homes.

Lewis, the second wave for your neighborhood will be gentrification, which will cause Yuppies to buy up your neighborhood, so that they can be closer to trendy downtown bars, and in walking distance too, so that when they head home in the late of night, they can relieve themselves anywhere, but since it won’t be “Loopers” from the past doing it, then it will be okay…. ….#ChiefCulture

( – and Woodstock adds: “I miss the ‘Loopers'”….”I could always bum a cig off one of them”…. )

Is a portion of that tripling of taxes an increase in the value of your property? Taxes have certainly increased all around town, so I’d agree with you that this is something we should be concerned about.

But again, if we are seeking to document the effectiveness of TIF’s, if they are effective, how do we do so without a self-interested measure from the developer as to what would have occurred without the TIF. Right, wrong, or indifferent we would all be skeptical of a study that is based on that sort of information just as it is easy to be skeptical of the study they shared yesterday. So seriously, how would you encourage the city or the developer to measure the effectiveness of the existing TIF’s?

While it is not correct, nor is it proper – it is not surprising that the crony capitalists would use an ‘economic impact’ value generated in the method of the Chamber of Commerce (complete with a ‘multiplier factor’) to justify something related to property tax relief measured against an increase in equalized property value. What. A. Joke.

That’s not how this works. That’s not how any of this works!

The City of Sioux Falls forces Minnehaha County and the Sioux Falls School District to forego increased property tax receipts over the life of THEIR (the City of Sioux Falls’) TIF gift to Craig Lloyd.

Perhaps the promoters of this scheme would like to share with Minnehaha County and the Sioux Falls School District the manner by which this ‘economic impact’ will pay the bills for them.

Imagine the smug satisfaction of the bean counter @ Lloyd Companies after application of the economic impact ‘multiplier factor’ in his/her spreadsheet brought the term of ‘pay back to the taxpayer’ to less than 1 year.

“They should be satisfied with that result, shouldn’t they?”

In before the resident crony capitalists with the term they always use to rationalize B.S. like this project, ‘bigger bang for the gov’t’s buck!’

– as if it should be normal that our government bodies are in the sole business of doling these gifts.

Topeka KS offers $15k for people to move there. Rather than developer tax breaks, this makes more sense. To live near the most polluted river in the Midwest amongst homeless alcoholics next to a railroad yard environmental disaster, pay each resident a million.

Gawd, they gotta get this bigbuck$ thing built before smiffieldz builds that new holding barn the mayor permitted. HOoo take ur smelly selfie now boy