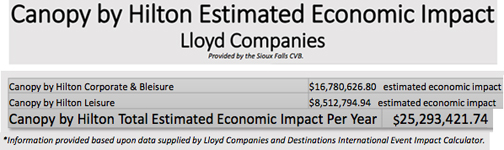

While I have no reason to argue with the data (maybe a little), what they left out of their presentation this afternoon at the informational meeting was that the supposed $25 million dollar a year economic impact doesn’t come from the owners of the development, it comes from their customers, whether local or visitors. They also left out that a large amount of this ‘economic impact’ goes straight into their pockets. So really, what is the justification of the TIF and BID Tax rebates?

When you build a ‘for profit’ business in a capitalist society, you expect to make a profit. Why should you be also rewarded tax breaks? I would think a ‘for profit’ private business that is expecting to have a $25 million dollar impact a year, wouldn’t need any handouts, breaks or rebates. I would think they would be smiling all the way to the bank and simply thanking the city for issuing the permits.

When I look at TIFs I always ask the same question, “What is the benefit to the public as a whole, you know, the ones who have to pay higher property taxes to supplement this TIF?” While I appreciate the study, the only thing it shows me is the money that it will be generating will mostly be helping them.

I would be willing to still give a BID and TIF to the development, but only for the benefit of the city. As I have suggested in the past, I think the city should gift them Kiwanis Park and grant them a TIF for the amount it would take to redevelop that part of the project and forgo the additional $10 million it is supposed to cost taxpayers to redevelop the river greenway, which really makes this a $32.6 million dollar tax break when you add it all together.

I think the city council should amend this TIF, make it a lot smaller and reduce the TIF time limit to 5 years.

After hearing the council tonight discuss the TIF, I have no doubt this will pass. And hey, if you want to support corporate welfare based on a study the developer produced (not the public) so be it, but at least ask for a study that shows the REAL benefit to the rest of us in this community who are paying 100% of their property taxes and always have. You know why they will never produce such a study? Because they won’t like the results.

You also have to take into account, the study they did on economic impact is a ‘prediction’. The study I have asked for is of our current TIFs and what benefit we are getting from them. This would give us REAL data to base their prediction on. Government should never base a 20 year, multi-million dollar tax break on ‘predictions’ of what could happen, but should base them on actual data that already exists. Will they have to courage to ask for it? Probably not.