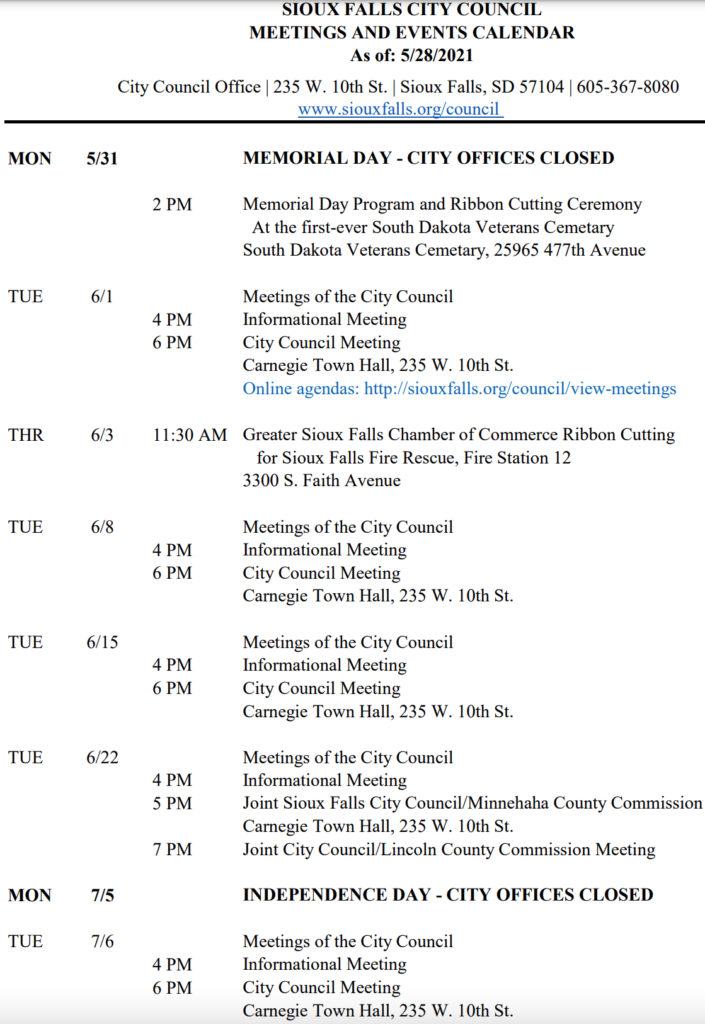

Informational • 4 PM • Tuesday June 1

MEP fee update (Mechanical, Electric & Plumbing) – No supporting documents

Regular Meeting • 6 PM • Tuesday June 1

Item #6, Approval of Contracts, Sub-Item #9, $187K to the Multi-Cultural Center. Wondering when we are getting an update on the dismissal of the director, oh I forgot, we don’t have open government. Still waiting to see our open government consulting contract with Putin.

Sub-Item #25, (re) Painting new buses. About $9K a piece. What are these? Bentley’s?

Item #31, Village River (Bunker Ramp fiasco) is transferring their liquor license to a hotel (likely owned by Lamont). ‘Yeah, heading over to the Homewood Suites for a High Ball and a steak.’ For F’cksakes.

Item #64, 1st Reading, Motorized Foot Scooter (rentals). This is an update to state law. I am assuming that one of the National companies lobbied in Pierre to get added to the books. They are cool. Have fun.

Item #75, A RESOLUTION DESIGNATING THE OFFICIAL NEWSPAPER FOR THE CITY OF SIOUX FALLS, SD. Apparently this thing still exists? Who knew.

Item #77, citizen board appointments. Apparently we are appointing former AG and Judge, Larry Long to the Charter Revision Commission. Get out the popcorn, this is going to be fun (not really) watching him kill proposals. He apparently is the new CRC hit man? Maybe not?

Item #78, Appointing Greg Neitzert and Erica Beck to Med Mary task force. I’m still curious why we need a task force to read a 24 page law that already passed.

Planning Meeting • 6 PM • Wednesday June 2

Item #5C, An Ordinance of the City of Sioux Falls, SD, Adding A Temporary Ordinance Regarding the Issuance of Local Medical Cannabis Establishment Zoning Permits and Licenses. Notice there is no recommendations. This will be an interesting convo.

Item #5 D-E, rework of Sioux Steel TIF. Apparently you can sit on your hands for a year, change stuff and come back and still get the developer welfare deal. Can you imagine going to your mortgage banker and setting up a loan to buy a house and postpone it for a year? Do you really believe you would get the same rate? Hell no. It may be better or worse, but either way, you would have to re-work it. Not with the city, developers can get millions in tax rebates and put that timeline out there for as long as they wish. Just look at Phillips to the Falls, the city held onto the land for around a decade, tax free, and handed out a TIF on top of it all to a developer. You would think the MOB is operating in Sioux Falls.

Item #5 F-G, TIF for Cherapa II, I guess the Planning Commission is going to busy Wednesday night handing out developer welfare while raising taxes on the rest of us. I find this TIF curious because the developer says it is for a parking ramp, but the councilors who had to wear knee pads at the informational meeting about it say it is about building roads, pipes and stuff. So which is it? Oh, that’s right, it’s for streets paved of BS.

Will there be Scooter While Intoxicated (SWI)? For 9K, how many buses painted?

Judge Larry Long, there’s an interesting story, at least he won’t be ruling on ethics.

Shouldn’t developer TIF funding be disbursed in partitions from a supervised escrow account that’s monitored with spending and accounting project purchase proof? I get the feeling it ends up as CEO bonus.

Daily Spin – as per State statutes, as the landowner/property owners pay their property taxes over the income 20 years, the “City” must establish a Trust Account/Bank Account in order to deposit the “Increment” portion.

11-9-31. Tax increments deposited in special fund–Municipal appropriations to fund–Investment of moneys in fund – All tax increments received in a district shall, upon receipt by the municipal treasurer or finance officer, be deposited into a special fund for the district. The municipal treasurer or finance officer may deposit additional moneys into the fund pursuant to an appropriation by the governing body. Subject to any agreement with bondholders, moneys in the fund may be temporarily invested in the same manner as other municipal funds.

State Law is also straight forward what the ‘funds’ can be used for, and how they can be paid out to the Landowner/Property Owner.

11-9-15. Items included in project costs -Project costs include:

(1) Capital costs, including the actual costs of the construction of public works or improvements, buildings, structures, and permanent fixtures; the demolition, alteration, remodeling, repair, or reconstruction of existing buildings, structures, and permanent fixtures; the acquisition of equipment; the clearing and grading of land; and the amount of interest payable on tax increment bonds issued pursuant to this chapter until such time as positive tax increments to be received from the district, as estimated by the project plan, are sufficient to pay the principal of and interest on the tax increment bonds when due;

(2) Financing costs, including all interest paid to holders of evidences of indebtedness issued to pay for project costs, any premium paid over the principal amount thereof because of the redemption of obligations prior to maturity and a reserve for the payment of principal and interest on obligations in an amount determined by the governing body to be reasonably required for the marketability of obligations;

(3) Real property assembly costs, including the actual cost of the acquisition by a municipality of real or personal property within a district less any proceeds to be received by the municipality from the sale, lease, or other disposition of property pursuant to a project plan;

(4) Professional service costs, including those costs incurred for architectural, planning, engineering, and legal advice and services;

(5) Imputed administrative costs, including reasonable charges for the time spent by municipal employees in connection with the implementation of a project plan;

(6) Relocation costs;

(7) Organizational costs, including the costs of conducting environmental impact and other studies and the costs of informing the public of the creation of a district and the implementation of project plans; and

(8) Payments and grants made, at the discretion of the governing body, which are found to be necessary or convenient to the creation of a district, the implementation of project plans, or to stimulate and develop the general economic welfare and prosperity of the state. No payment or grant may be used for any residential structure pursuant to § 11-9-42.

11-9-42. Tax increments not to be used for residential structures – No tax increments shall be used for the construction of residential structures.