We found out a few years ago that the Planning Department in collusion with the Mayor’s office has a list of PRIVATE developer and corporation tax rebates. The kicker is all of the rebates are approved ONLY by the discretion of the Mayor. There is NO City Council OR public review of the rebates. The mayor simply signs off on them. While they can be seen by the public you have to know who to ask. There are NO public presentations of the recipients.

How do they work? Basically a developer or company, or investment group (LLC) makes significant upgrades to the property and a portion of the cost (usually around half) is rebated back to them from their paid property taxes. Like TIFs, it is only an option for a select few and extremely UNFAIR to the 99.99% of property taxpayers in the community.

Now, I’m not going to cry corruption, I’m just going to keep this simple, it is time to end this welfare handout because 1) it goes against the FREE market system but more importantly 2) The mayor should not have this kind of power and control to secretly hand out tax rebates to whomever he wants to.

I think the City Council needs to end this process ASAP.

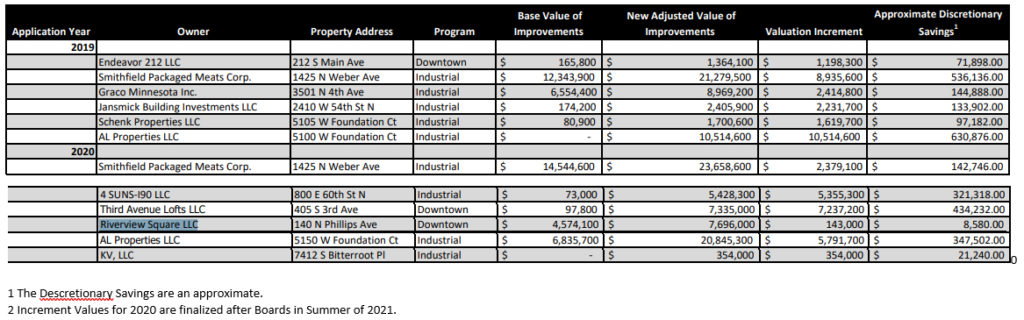

You will see below how random and highly questionable the recipient list is which adds the element of corruption;

• Endeavor 212 LLC, Dr. Richard Brue, Historic DTSF Property, this one surprises me since downtown property is very valuable and certainly doesn’t need a tax break.

• Smithfield, this company owned by Communist Chinese investors got a massive tax break in 2019 and again in 2020.

• Graco Minnesota Inc, this very successful company based out of Minnesota got a tax break. Why?

• Schenk Properties LLC and AL Properties LLC may be intertwined with Murray properties and they have gotten massive tax breaks in Foundation Park for 3 different properties in 2019 & 2020.

• 4 Suns-I90 LLC, I believe has developed property on North Cliff and 60th, they are based out of Fargo, ND. So I guess we don’t only give tax cuts to the Chinese but also our Northern neighbors.

Third Avenue Lofts LLC, Riverview Square LLC are Legacy Projects intertwined with Norm Drake. So I guess the mayor felt it was okay to give a tax break to a guy involved with the Copper Lounge collapse and the Bunker Ramp debacle.

KV LLC, this one is a mystery, but seem to be based out of Sioux City, SD.

‘4 Suns-I90 LLC’, are they the ones who once left the following sign visible from I-90: “FU Sioux Falls”… ?

Good discussion points, but would this be something the Mayor or Council can change? I believe State Statutes govern tax rebates regarding Sales and Property Tax, and they can be requested, asked for, and handed out.

Yes, the Mayor as the at large representative of the people must represent all five districts, all 195,000 people equally, but I would think the person asking for the rebate(s) still have to go thru the formal process to apply for them, which I think, I could be wrong, correct me please – that person first have to go to the County and the County Commission has to approve the rebate.

I dont know if this process is unfair, cause the State rewards Rebates, Tax Freezes, and Abatements all the time, and they come before the City Council monthly.

If I am understanding your sentiments correctly, you would oppose rebates on Business Owners/Investment Group, but favor more rebates, abatements, and tax freezes for the citizens.

I believe you are correct, these sort of things must be equally applied to all residents of the City.

How do you vision this Rebate Program working in the future, do we need to create a new process to vet those who apply, or do we have to be more mindful of all people who do apply?

Mike, the mayor alone signs off on it. What I don’t know is where those funds come from, but I would assume the SF city property tax fund. This is not a program with the counties or school district. I think Huether started it.

Huether had a slush fund kitty for tax relief. Any left for new siding?

§ 37.135 GENERAL – When a property tax rebate is included in the city’s budget, no rebate shall be paid unless the owner of eligible owner-occupied single-family dwelling property has complied with the provisions of this subchapter.

§ 37.136 COMPLIANCE WITH STATE LAW – Property tax rebates budgeted by the city shall be paid for non-ag owner-occupied single-family dwellings.

§ 37.137 TAXES TO BE PAID – In addition to the above requirement, no city property tax rebate shall be paid for any property for which taxes and assessments due have not been paid in full to Minnehaha County and Lincoln County treasurers on or before October 31 of the year in which they are payable.

§ 37.138 PAYMENT BY DECEMBER 31.

Any authorized rebate shall be paid not later than December 31.

§ 37.150 ABATEMENT OR REFUND OF INVALID, INEQUITABLE OR UNJUST ASSESSMENT – If after application, signed by the taxpayer under oath stating the reason the assessment is invalid, inequitable or unjust, the council is satisfied beyond a doubt that the assessment of real property described in the application for abatement or refund is invalid, inequitable or unjust, the council, if the application is filed no later than the first day of November of the fourth year after which the assessment would have been delinquent, may by resolution abate or refund all or any part thereof in excess of a valid, just, fair and equitable assessment.

2007 is when they added the Property Tax Rebate to city code, under the Dave Munson administration.

I believe the person requesting a Rebate on their property tax has to apply, make sure they have their property tax paid in full, and upon meeting all the criteria, must be approved by the Mayor, and go before the City Council to become part of the Budget. I would imagine total ‘rebates’ would have to be factored into the next years budget in order to account for the rebate to be given.

More interesting is process involved to a refund on Sales and Use Tax as per 37.165 thru 137.175.

Any such rebate (property tax) or refund (sales tax), the applicant has to make improvements to provide for single family housing or public property.

37.175 – All monies refunded pursuant to this ordinance shall be deemed to be continually appropriated without further action by the city council.

I would believe all applications get sent to the Finance Director, and must be approved by the director, then signed off by the Mayor.

4 Suns own the property with the FUSF sign. Great choice facebook boy mayor!

“‘FU’ signs are permissible up on North Cliff, but had they had done that in Taupeville a group of vigilantes from LimitlessMale would have ran them out of town”…..

Mike Z – FWIW, the language of the statute you refer to only applies to “eligible owner-occupied single-family dwelling(s)”. Not to commercial or multi-family properties.

Ruf is right, also this isn’t called a rebate, even though really that is what it is, it is a ‘discretionary’ fund. No mention of rebates or property taxes. This description tells you everything you need to know, it is at the discretion of one person, the Mayor no matter how many lower rungs on the latter sign off on this. Maybe the money just comes out of the general fund, not sure. My bigger point is that this program makes no sense. It looks corrupt, but that aside it lacks transparency and the checks and balances. The city council should be the only group to approve these, just like TIFs. But unlike TIFs that are kinda vetted in public meetings, these are not. They are simply a handout from the mayor of our tax dollars. And anyway you want to twist it, that is fundamently wrong and unfair.

If a mayor can have a “discretionary fund” without legislative approval (Well, I guess they did approve his “discretionary fund”.), then how is this DF any different than Munson appropriating funds for the Phillips to the Falls project without city council approval back in the day? Just how much liquidity is there with an approved city budget? How much can a mayor legally move money around? Because I know a pothole in my neighborhood that could use some very serious tar liquidity.

( and Woodstock adds: “Maybe there’s enough liquidity to take the whole damn city council to earthquake stricken Haiti”…. (“When you get there, you’ll finally find out what it’s really like to be a minority”… (“But why not just go to Pine Ridge then?”…. (“SHUT-UP!!!”…. “And get rid of those damn white sole shoes and find some dirty tennie-runners so you can really fit in here”….)))…. )

This may be more what you are talking about – the definition of the term “DISCRETIONARY” is defined in Section 37.090 of this section. This section may be what you all are referring to, and explains exactly how the “tax rebate” is to be determined, and it also states that Planning and Development Services must provide the City Council a report of all “qualified new construction projects” that qualify for the abatement. So the Council would have to aprove the projects apportioning the ‘value of such expense in the upcoming fiscal season.

—

REDUCED TAXATION FOR NEW COMMERCIAL STRUCTURES OR NEW COMMERCIAL RESIDENTIAL STRUCTURES

OR ADDITIONS, RENOVATIONS OR RECONSTRUCTION TO EXISTING STRUCTURES LOCATED WITHIN THE CITY’S

DESIGNATED AREA OF THE CITY

§ 37.085 AUTHORITY – This subchapter is adopted pursuant to the authority granted to the municipalities pursuant to SDCL 10-6-35.4.

§ 37.086 DEFINITIONS.

(a) The term COMMERCIAL STRUCTURE as used in this subchapter shall include:

(1) Retail services and trade establishments as defined by §160.015 with a total floor area as defined by §160.015 with a building footprint not exceeding 10,000 square feet on the premises, excluding the following uses:

A. Adult use, as defined by §160.015;

B. Off-sale alcoholic beverage establishment, as defined by §160.015; and

C. On-sale alcoholic beverage establishment when it is the principal use as defined by §160.015.

(2) Personal service establishments as defined by § 160.015;

(3) Day care center as defined by §160.015;

(4) Boarding house as defined by §160.015; and

(5) Office building as defined by §160.015 with a total floor area as defined by §160.015 with a building footprint not exceeding 10,000 square feet on the premises.

(b) The term COMMERCIAL RESIDENTIAL STRUCTURE as used in this subchapter is a residential structure containing four or more dwelling units,

excluding group homes.

§ 37.087 APPLICABILITY; EFFECTIVE DATE – This subchapter shall apply only to those new commercial residential structures thereto, or additions, renovations, or reconstruction to existing

structures located within the city’s designated area as set forth in Exhibit A of Ord. 60-07, adopted May 7, 2007, and to those new commercial structures

or additions, renovations, or reconstruction to existing structures located within the city’s Folsom’s Addition as set forth in Exhibit B of Ord. 60-07, adopted May 7, 2007. It shall apply to new structures or additions thereto on which construction has been commenced after May 1, 2007. It shall also apply to renovations or reconstruction on which construction has commenced after May 1, 2007

§ 37.088 CALCULATION OF TAX.

(a) All new commercial structures or new commercial residential structures thereto, or additions, renovations, or reconstruction to existing structures,

which new structures or additions or renovation or reconstruction have a full and true value of $30,000 or more, added to the real property and located

within the city’s designated area as set forth in Exhibit A of Ord. 60-07, adopted May 7, 2007, shall be taxed pursuant to the following formula during the

five tax years subsequent to the completion of their construction:

(1) The full and true value of the structures, additions, renovation or reconstruction shall be determined in the usual manner by the director of

equalization;

(2) For the first tax year following construction, 20% of the taxable value shall be used for taxation purposes;

(3) For the second tax year following construction, 40% of the taxable value shall be used for taxation purposes;

(4) For the third tax year following construction, 60% of the taxable value shall be used for taxation purposes; and

(5) For the fourth tax year following construction, 80% of the taxable value shall be used for taxation purposes.

(b) The taxable value of the structures, additions, renovation or reconstruction during any of the five tax years subsequent to the completion of their

construction may not be less than their taxable value in the year preceding the first year of the tax years following construction.

(c) For the fifth and all subsequent tax years following construction, the structures, additions, renovation or reconstruction shall be taxed in the same manner as all other similar industrial or commercial or commercial residential property within the city.

(d) Any structures, additions, renovation or reconstruction, the construction of which is only partially completed on any assessment date, shall be

assessed for taxation purposes in the usual manner.

(e) The new construction tax incentive shall be discontinued if the business use changes to a nonqualifying use during the five-year period so that it

would be ineligible under the new use.

§ 37.089 APPLICATION FOR REDUCED TAXATION ON NEW CONSTRUCTION.

(a) Any person desiring to claim reduced taxation on new construction shall make application to the planning and development services department on or before October 1 in the year in which the project is completed and shall first appear on the tax rolls as a completed or modified structure. The application shall be submitted on a form prescribed by the city. Upon planning and development services’ approval of the application, the staff shall notify the applicant within 30 days stating whether the facility is eligible to receive reduced taxation.

(b) In January, the year following completion of the project, planning and development services department will certify those improvements which qualify for reduced taxation to the director of equalization in the county in which the real property is taxed. New construction tax incentives are not assignable or transferable, except as collateral or security pursuant to SDCL ch. 57A-9, Secured Transactions.

§ 37.090 DISCRETIONARY FORMULA REPORT.

In July of each year, planning and development services department shall submit a report to the city council of all eligible completed new construction

projects which qualified for the discretionary formula beginning in December of 2008. The report will include the description of each qualified property, the base full and true taxable value, the new adjusted full value of new construction and improvements and the amount of discretionary loss of taxable value as defined in city ordinance of 100%, 80%, 60%, 40% or 20% for each year of the eligible tax abatement.

—

Section 37.105 to 37.120 establishes and creates the BUSINESS DISTRICT(s). If anyone is interested.

One man awarding million dollar public money gifts unchecked and unencumbered is not only irregular, it’s preposterous.

You post a lot of dumb stuff, but this is actually right on. This may be allowed in ordinance, but should absolutely not be allowed. How many tax incentives get stacked like this plus a TIF? The discount should be at the discretion of the council, not a single elected official. If warranted, give it, and should be in public forums.

I can only imagine the roll call of handouts which Huether doled out.

Guernsey, you should probably request that data and back up your statement. Your hate for Huether who has been out of office for nearly four years clouds you judgment. PTH has given away massive TIFs in comparison. The foundation park TIF alone is probably larger then all of Huether’s combined.

I have the record back to 2008, I will put up soon. As far as I can tell this is probably vetted through the Development Foundation and Chamber, but keep in mind only one person signs off on this, non publicly, that is the mayor. Most if not all the projects have nothing to do with good paying jobs or affordable housing. On its face it is simply a handout.

“So let me get this right, the South Dakota Supreme Court doesn’t rule on Maryjane until they vet their decision with an outside attorney, and the Development Foundation and Chamber tell the mayor who to give tax rebates to? Who in the hell is running this entire joint, anyhow?” #SouthDakotaINC

Deep gratitude to the blogmaster (or one of the Foot Soldiers) for doing the heavy lifting and incorporating this historical record into a new blog post (as was requested in the Comments here).

I can only hope that Banned reads the new post. Between us girls, Banned, “OMFG!”

BTW, it is tyranny which I hate, not withstanding the person or political party engaging in tyranny. Have had lots with which to work in this city and state. It didn’t start with PTH (and we agree on the give aways by PTH).