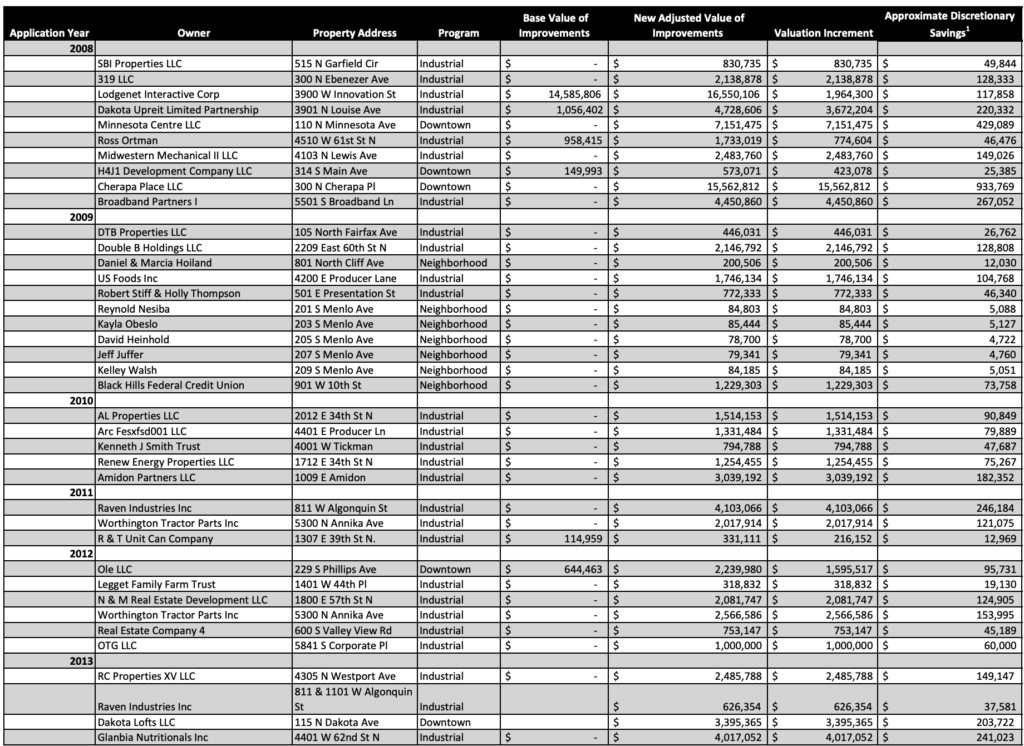

Here are the Mayor’s Discretionary Funds (slush fund) starting in 2008. Remember, the last mayor hid it from the public and council and while the council got to see it after his term it still doesn’t make it right.

From my assumptions so far the money comes from the general fund (1st or 2nd Penny) and it is signed off by ONE person, the Mayor. I can’t find anywhere in city ordinance that this is approved by anyone else but the mayor. It may go through a review process, but as far as I can tell the applicants probably work through the Development Foundation and the Chamber and then the Planning Department. But at the end of the day the mayor doesn’t have to approve a single application . . . but he does . . . in the dark of the night.

(Click to enlarge)

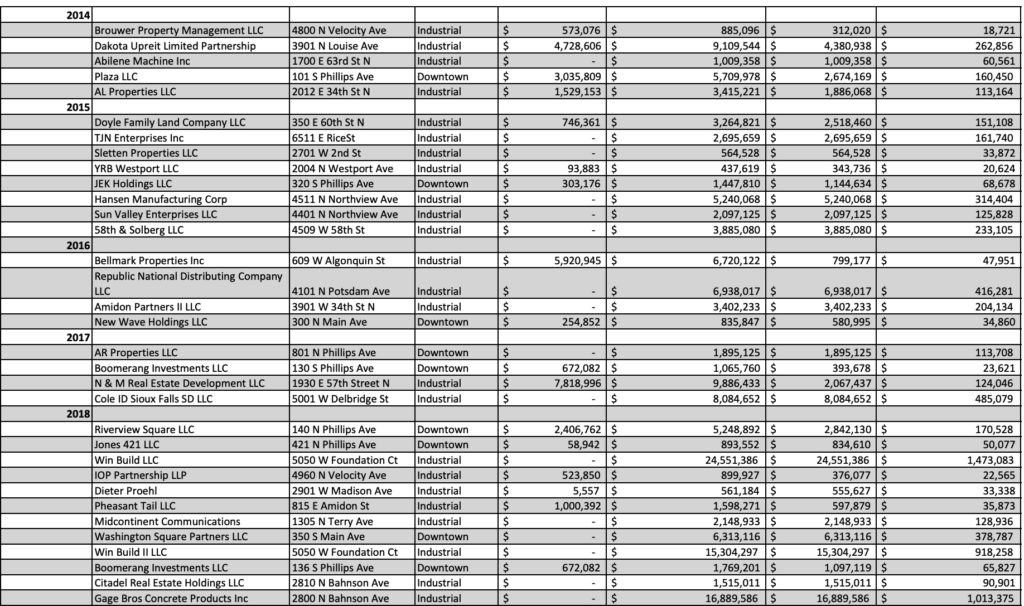

Boomerang Investments LLC? That’s better known as Legacy. Or, what some would call Load-bearing, Permit Lacking, Collapse, Morbidity/Mortality & Asbestos.

( and Woodstock adds: “Say, don’t forget about the temporary dog park, too”…. )

Whole lot of $s destined to Legacy / Norm Drake / Paul Cink / Larry Csnfield / Aaron Hultgren.

At what point and in what role was Darren Ketcham involved in these? Was he involved in doling the $s? Receiving the $s? Both?

At least the common man got something here (Reynold Nesiba).

Must have been when Huether was still a Democrat.

AND, these “adjustments” were done for Boomerang a year or two after the collapse. But then again, this is the same time frame that this crowd was in the mix once again with the Bunker Ramp as well.

( and Woodstock further adds: “Maybe a second collapse would have left a greater impression”… )

The number of LLC’s is extraordinary. For $50 anybody can become one and annual reports are not required. Money is often parked in an LLC because there’s no corporate income tax in SD. Basically, these city discretionary funds go out the back door and disappear. Why is this happening?

With all due respect, D Spin, annual reports ARE required of LLCs.

The level of information required, however, is more in line with that required of Colonel Hogan when requested by Colonel Klink in Stalag 13 (i.e. name, rank and serial number).

The Secretary of State is not the Securities and Exchange Commission. Simply a toll collector for the state.

Nothing wrong with all 195,000 residents creating a LLC themselves, I encourage them to do so, its a perfect way to “AVOID” Federal Income Tax. I have said it for years, Avoiding federal income tax means I got more money to spend inside the State, which means the State collects more sales and property taxes let alone other Misc-Excises, Duties, and Imposts.

IT is why ‘we’ businesses flocking to South Dakota.

I have created 2 LLC’s in my life, and I am thankful that South Dakota is a “TRUST” heavy State.

Mike, over half of federal income taxes go to the military and also S.D. is a welfare state and couldn’t survive without Federal dollars. So with your philosophy you want us to become an unprotected poverty state? If you don’t like contributing to the well-being of this nation you have an option, leave. I gladly pay my income taxes because I live in the greatest country in the world and I believe that it is anti-American and unpatriotic to not do so

Scott, respectively, I urge you to fully understand how the Federal Government funds itself, the federal programs provided, pay its federal officers, officials, employees, let alone provide for the services of the Federal Govt.

No, the “federal income tax” does not provide for the military, much of the U.S Military is funded solely by the Corporate Excise Tax paid by the Multi-National Corporations who do business throughout the “federal territory” and directly contracted to the Federal Contract.

Much of the personal income taxes which are 100% voluntary, fund the the growing “DEBT” taken on by the Federal Govt.

The U.S Postal Office is self funded by DUTIES (user fees) charged to the users; the Federal Highway System connecting D. C to Federal Properties in each of the 50 States are paid for by the Federal Excise Tax on Fuel; and the National Park System is self funded solely on DUTIES (user fees) paid by those who pay to use them.

I pay Federal Taxes every month before I pay one dime worth of federal income tax, as a Self Employed Worker, I am assessed 15.3% Excise Tax on my Net Income which funds my Social Security and Medicare, but then again, I cam restrict this Taxable AMount by investing that money back into my business, my properties, etc.

So before you tell me that I do not contribute, which was not true, please understand the # of “federal taxes” I do pay, let alone what you pay during a course of 12 months.

I pay Federal Excises every time I pay my Electric Bill, Natural Gas bill, put gas in my cars, pay my phone bill, pay my cable and internet bills, let alone thanks to the business I am in, I pay the U.S Post Office nearly $1,500 a year in stamps, service fees, etc. I know what I am paying in federal taxes.

I am NOT a “multi national corporation” I do not have to pay the Corporate Excise Tax, unless I elect to take the corporate status on my 1065 as my LLC files the assessment.

I am a SOUTH DAKOTA Licensed and Bonded Business, doing business “inside the borders of my state” – I have a right to keep my GROSS INCOME invested inside that “State” of which allows me to save my money, and spend that money inside the State where I now pay S.D Sales Taxes, User Taxes, Property Taxes, and Other State and Local Taxes.

The more I can keep untaxed by the FEDS, the more I can spend in South Dakota, and that means “More Revenue” for the State Government and the City of Sioux Falls to pay for State and Local Highways/Streets, Police, Fire, Rescue Services, Public Parks, etc.

My Philosophy as an “Anti-Federalist” is to protect my sovereignty as an American Citizen of South Dakota, helping to keep South Dakota a Free and Independent State. That is guaranteed under Article 6

But Mike, if you don’t pay more federal taxes, then the Feds have to run bigger deficits to keep spending more federal tax dollars in South Dakota than South Dakotans send in taxes to Washington.

Bragging about not paying taxes will put you in the front of the line for the reemerging tax auditors. Good Luck!

The pre-Reagan auditors are back. Now, do the once air traffic controllers want their jobs back, too?

I think you people are NOT understanding how the Tax Code actually works. I think you may have to ‘read’ the law for one. So this discussion is done until you read the 10,000 page tax code.

How do you think AMAZON gets away with paying 0% Corporate Excise Tax on their profits?

It is goes they are NOT realizing any profits, they are taking 100% of their profit and reinvesting back in PROPERTY, buying land, New Construction of Buildings, and Expanding their Payroll Liability.

The FEDERAL INCOME TAX is the biggest SCAM ever put upon the American People, cause it is 100% Voluntary. but so many people sign those W-4’s and W-9’s rather than simply selling their labor to 1,000 people a year @ $600 each. If no one ever pays you more than $600 they do not need to report it, if they do not report they paid you $600 you have NO LAWFUL Obligation to report, thus its 100% PRIVATE INCOME.

So – Work for yourself, contract to 1,000 people for $600 a year, and you will get $600,000 cash over 12 months.

Then you invest that $600,000 in capital assets, land, buildings, etc, and bam – you got yourself a 0% TAX RATE

Mike should have had his own late night infomercial back in the 80s before the ’87 crash.

He reminds me of that one stock market guy from about ’86 – with only a few strands of a comb over – who used to say over and over again during his late night infomercial, that: “It’s very, very easy”… “All you have to do is buy when it’s low and sell when it’s high”…

Also, I think tomorrow, I am going to go to all of the fast food places in town and get a bunch of $600 jobs… (I hope they will work with my schedule…) #ProblemSolved

This is not complicated man – just buy yourself a good lawnmower, and go out and contract privately to 1,000 people a year to mow their yards every month, over a course of 1 year, you collet $600 from each of them. There ya go – why make it so hard? $600 dollars does not have to be reported, you put the cash in your piggy bank and pay your bills as you go, invest the profits back in new equipment, and bam.

But now thanks to BIDEN – if you put cash in a bank account, the IRS now will go and watch all your deposits and spending habbits if you keep no less than $600 in the account.

Create your own bank as “MISS PIGGY BANK” and your account # is 1-2-3-4-5-6-7-9-0

Are those Husqvarnas any good? I like Volvos. And miss the Saabs.

Wait a minute, its the aggregate of a bunch of $600 lawn mowing accounts that matters. You would still have to claim them in their entirety. Nice try though.

Oh, and I am still using my ’83 Craftsman by the way.