It didn’t work when Reagan proposed it, and it won’t work now. IRAB (INFRASTRUCTURE REVIEW ADVISORY BOARD) is proposing waving platting fees for new housing developments;

INFRASTRUCTURE REVIEW ADVISORY BOARD (IRAB) MEETING IS SCHEDULED FOR JUNE 1, 2022, AT 8:00 A.M. LOCATED AT THE DOWNTOWN LIBRARY, 200 N DAKOTA AVE, SIOUX FALLS, SD

AGENDA:

1. Approve June 1, 2022 Agenda

2. Approve May 4, 2022 Meeting Minutes

3. Light and Power Update – Developer Procured Street Light Materials

4. Proposed Revisions to 96.220 – Arterial Street Platting Fee

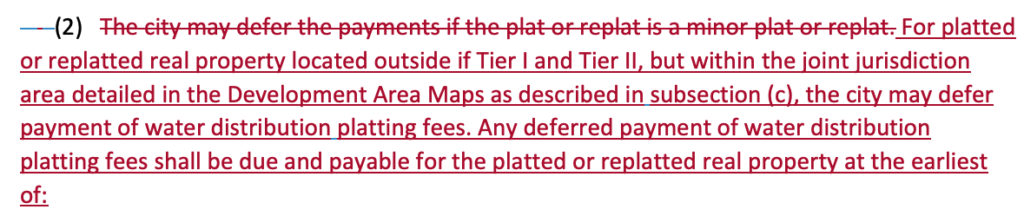

5. Proposed Revisions to 51.065 – Water Distribution Platting Fee

6. Proposed Revisions to 51.118 – Recovery of Cost of Storm Water Drainage System

It seems developers want tax breaks for building new homes, and they will supposedly pass those savings on to homeowners. That will NEVER happen. The demand for housing is at such a high level right now developers have ZERO reason to pass on those savings, they will likely pocket the savings.

DOCS: Agenda, Distribution, Drainage, Streets, Minutes of last meeting.

UPDATE: This story lays out why housing is so expensive. WAGES!

Trickle down or not, why haven’t they been doing this for at least the last twenty years?

Certainly give incentives but restrict each developer to no more than 3 home lots. There’s a monopoly that once broken up presents an affordable better construction climate. For NE. slums, how about the city pays to demolish condemned or abandoned homes provided there’s a mobile home replacement?

You can build affordable homes in SF, they just need to be smaller and module (built offsite). This one intrigues me;

https://www.youtube.com/watch?v=hh_tsBbItpU

https://www.boxabl.com/

The great part is if you want to move, you can fold up the house and pull behind your vehicle like a camper.

Allowing landowners, property holders, developers to pay LESS platting fees to build on thier land, allows them to do so at a much cheaper rate, I am 100% for this. But let’s face it – “WE” will not fix nor cure the housing crisis, let alone create affordable housing until ‘we’ get the BANKERS out of the equation. Until we convince people to work towards saving 10% of their Annual Incomes for a period of 30 years from ages 18 to 48 abling them to purchase a home using “CASH” at 0% interest, your not going fix a thing. IF the average Sioux Falls resident is earning an average Gross Wage of $54,000 a year, and considering that both the Husband and Wife both work, thus generating a collective $100,000 a year – if they were to invest/save $10,000 a year for 30 years, that would be $300,000 b by the time they reach 50 years old. They would be able to purchase a nice home; not only that, even if they did so for 15 years from today, 2022 to 2037 – they be able to purchase a home for $150,000 which does in fact buy a pretty decent home in Sioux Falls, let alone allows you to at least pay 50% of a $300,000 dollar home, which kills how much “interest”, let alone the builders are gettign CASH UP FRONT which saves money as well. But then again. We live in this society where you need a HOUSE “NOW” rather than 15-30 years later. NO ONE saves today, let alone plans for the future. Until then, you will not fix affordable housing.

If we all started to save our money, then a recession would set into place, and then many of us would lose our jobs because of that….

So, pay $1000 a month rent for 30 years, so you can buy a house? What sense does that make? I guess it would be great if you are the slum lord raking in all the $$$$?

Define “affordable housing”. That would be a good place to start.

And, “fold up your house and pull behind your car”, good one Scott!

K4D! (Contract for Deed) ….. That way the “rent” goes towards the principle value of the home. We need to promote this more so more can be home buyers.

“‘affordable housing’, you ask?”…. “Perhaps, one you can afford”…. “As far as folding up your house and pulling it behind your car, I believe that’s called a trailer and it’s been working for the Irish Travellers and Gypsies for years”….. “We could learn from them”….. #StayOneCountyAheadOfTheSheriff

It appears “savings-investing” is a foreign concept to some people. I was clear – A Husband and Wife who generates a gross income of $100,000 a year can easily save, invest, set aside $10,000 a year for no less than 15 years to purchase a home for $150,000 let alone sacrifice at least the front end of their marriage to create a great nest egg later in their marriage. Oops, I forgot, Democrats are pushing to involve more “government” in their lives, and want the “Savers” and “investors” to now pay for them today. The point to savings/investing is to live like no one else tomorrow, while living like no one else today. Oops, I used a Dave Ramsey metaphor against you.

Now, Dave Ramsey, that’s the guy who makes millions explaining the obvious to people, right? Is he the same guy who has talked everyone into buying bottled water, too? Or, what about the proliferation of gambling in our society as a hidden idiot’s tax?

It is a disservice to the argument, if it is to be taken seriously, to not qualify the distinction between what and where the needs exist and how they are to be targeted. Is the specific need and remedies to be aimed at affordable or subsidized housing. There is a difference, and they have different solutions. To muddle the topic without a clarification only adds to the inability to advance any resolution.

After a glance at the composition of this advisory board, this policy initiative should not comes as a surprise.

If you are working with people in an advisory capacity who truly believe that platting fees are a limiting factor toward increasing the housing inventory … in this environment of the national housing market or in the red hot regional economy …, you have to ask yourself, “Am I working with the right people?”

If your financial resources are such that the platting fees are a ‘make or break’ in land development, you probably don’t belong in land development.

If cost of land, suitably developed for construction of housing, were a limiting factor, there would be parcels every where about town, sitting dormant because no one is willing, nor able to buy the land and build upon it. Frankly, that is not the case. At all.

Simply another handout. A naked attempt to socialize land development costs in order that you and I (as tax-paying citizens) bear the burden of these costs, rather than the benefactors (the land developer, the builders and contractors and eventual homeowners).

On the topic of “am I working with the right people” and the composition of this advisory board –

Would it now be appropriate to have City staff hold endowed positions of employment, much like in academia an endowed faculty position or an endowed administrative post (endowed Dept Chair or Dean)?

Jeff Eckhoff receives my nomination to the Sioux Falls Development Foundation Endowed Directorship of Planning, City of Sioux Falls.

Never been a give away that he didn’t think was a good idea.

In what has historically been (and still is) a red hot regional economy, to give away that which this guy recommends, you are either: working directly in the interest of the Sioux Falls Development Foundation, or you are a fool, totally devoid of understanding of the principles of a free market economy.

Who might occupy the Sioux Falls Contractors Association Endowed Directorship of Building Services?