UPDATE III: I wanted to make a correction to some of the things being said about how the homeowners will be paying back the TIF. While I have surmised from Mr. Powers testimony last night that the repayment would go back to the developer, SF Simplified was told this from the city’s planning office;

The $2.14 million would help with the costs of getting the site ready for homes, designing, etc., and it’d be paid back to the city over the next 20 years via property taxes.

Which makes more sense since the city is footing the bill for the infrastructure, but it still puts into question what was said at the meeting last night.

Does the developer take on the $2 million in debt or the City? Is it a 15 or 20 year TIF? I’m not sure who is in charge of talking points for this project, but it gets more confusing by the day.

A city official told me today that the payback to the TIF will actually go to the bank who is giving the loan for the development, which makes sense. Oh, and guess who that bank is 🙁

UPDATE II: Finally! At the planning commission meeting tonight, commissioner Larry Luetke asks how the TIF works when it comes to the eventual purchaser. Planning staffer, Dustin Powers explained that as people purchase the homes they will have to pay their FULL property taxes then the county will pay part of those tax funds back to the developer until they hit the $2 million amount. In other words the developer is paying the full cost of the development and the homeowners will be paying back the developer thru their taxes over the next 15 years. So essentially, like Starr said last night, this is just a $2 million dollar break on the development itself, for the developer, and gives the eventual homeowner NO tax savings.

On top of that, there are NO guarantees the pricing will come in where they would like them to. The developer has already warned those prices could fluctuate (in other words go up) and there is no contractual agreement to keep the price where promised. Good for the developer, not so good for the homeowner.

*on a separate note, one of the newer commissioners called roads in a development ‘artillery roads’ instead of ‘arterial roads’. I’m not sure what an artillery road is, but if you drive around some central neighborhoods you can certainly see some streets that look like they got hit by artillery.

UPDATE: Tonight at the city council informational meeting they did a presentation on the TIF and it’s hard not to come to the conclusion that developer, not the future homeowner is benefitting from the TIF. Councilor Starr said it best when he suggested that maybe the city should just pay for the $2 million in TIF expenses (infrastructure) out of the general fund and not mess around with the TIF.

Either way, the half ass promise made from the administration, planning and the council before the last election is we were going to target affordable housing in our core, building density while cleaning up our central neighborhoods. Instead we got a ham and cheese sandwich made from Spam and Velveeta.

———-

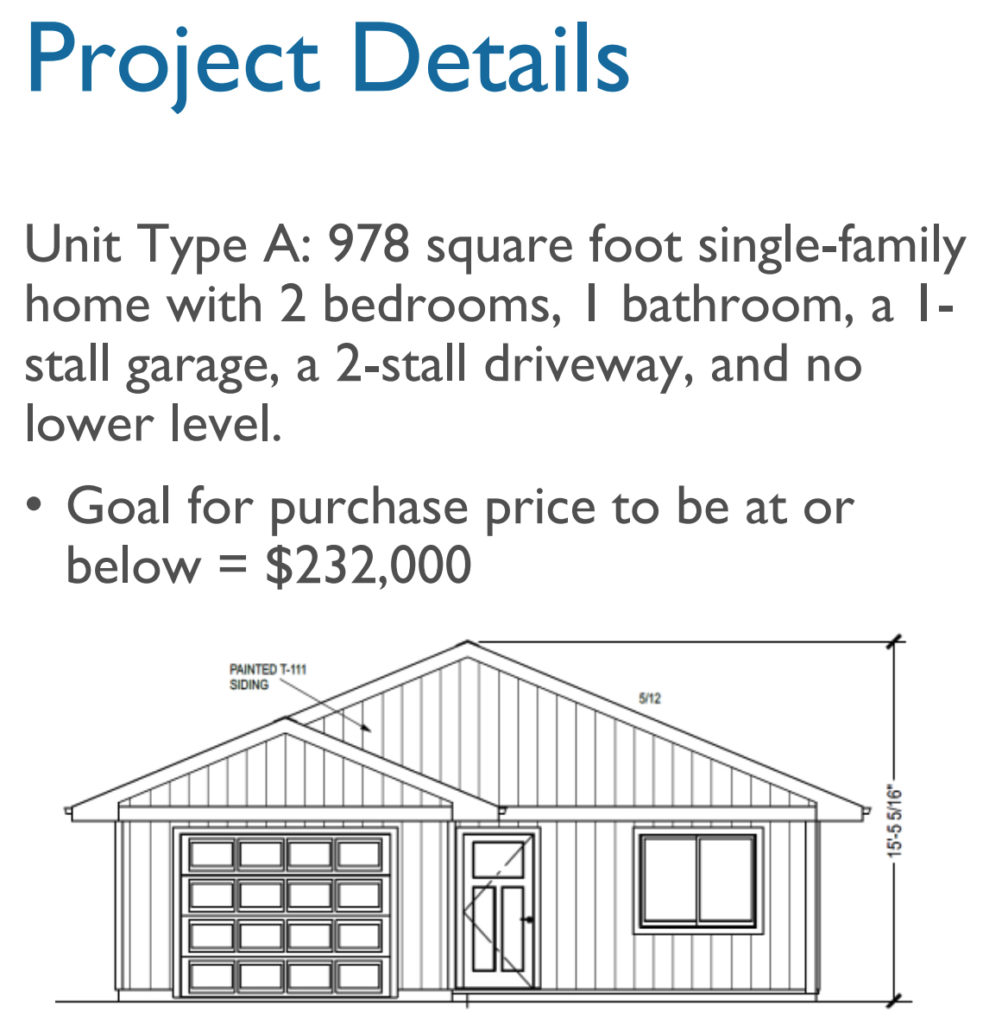

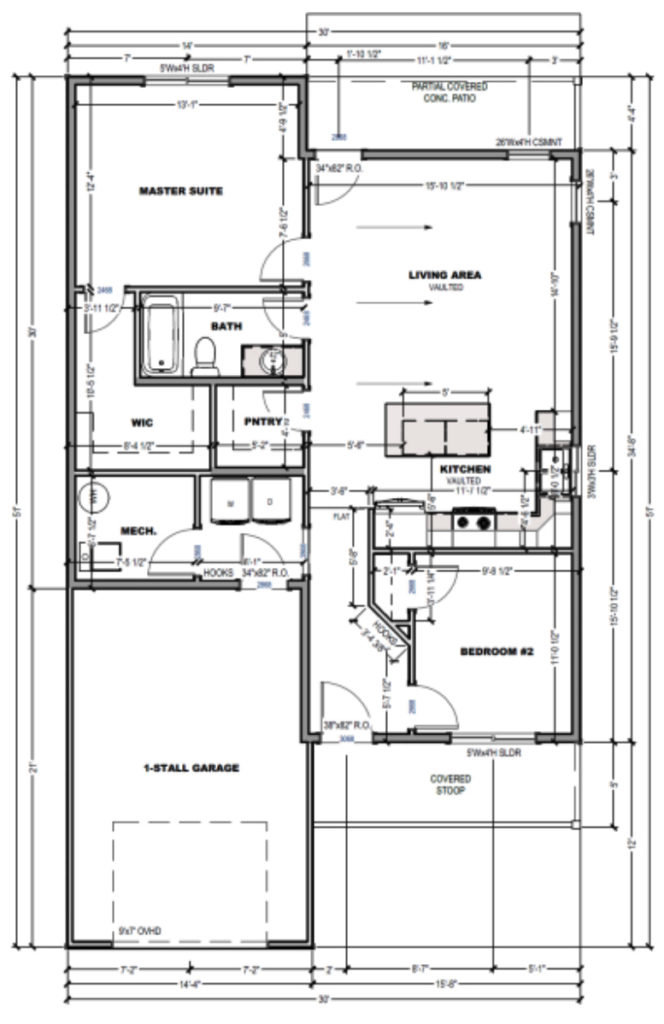

The Sioux Falls Planning Commission will be mulling over TIF #26 (Items 5C & D) this next Wednesday. As you can see from the drawings below these are pretty tiny houses. I was also surprised by the floor plan in which the bedrooms were not placed next to each other with one bedroom next to the front entry.

What is curious is there is NO mention in the agenda documents about who will be getting the 15 year tax break. The developer or the new homeowner? There is also the infamous recommendation from un-elected paid planning staff;

Both staff and the development team believe this amount of TIF support is appropriate and adequate for the project to move forward, and that without TIF in this amount, this project as presented would be unable to move forward.

The classic ‘We can’t do this without the TIF.’ But again, I ask, who will be getting the tax break? How do you give a 15 year tax break to a developer who will be selling the homes? Will the new owners be getting a 15 year tax break? I’m puzzled how this will work. It appears to me that the developer will be getting a $2 million dollar tax break up front and the new homeowner will have to pay the normal taxes.

Hopefully we will hear an explanation at the meeting.

*You will also notice that the planning agenda is NOT using the annotated agenda like the city council is using now. Not sure why transparency is so hard for these folks?

Do they still sell cancer insurance for those with cancer in their families? But what about tornado insurance if you live in a slab home without a basement? And how much does it cost?

$2.1+ million to reimburse a developer for costs which are typical of land development to build residential housing (from the document: “… development of roads, infrastructure, utilities, professional services, and fees …”).

A gift of nearly $55,000 per lot (39 single home lots).

Nope! Hard pass.

Go ahead and build out the tract with shabily constructed rental townhomes (and without the rezone and absent taxpayer subsidy).

Slab on grade. At least they won’t require that scam radon mitigation.

I like Spam and Velvetta. Just not together. Great analogy!

But, seriously, you want to talk about affordable housing in the core neighborhoods? Watch Sanford closely over the next three years. Most of those houses they own will be going bye bye.

Have any of you been to the Spam Museum in Austin, Minnesota? It’s a great place for the kids. They have a play land assembly line there, where the kids can cram pretend Spam into canisters. It’s a great workforce development experience for kids as well. Most Taupeville toddlers need to go there “Someday” with their Griswold parents.

Oh, speaking of the Griswolds, Aunt Edna always enjoyed a Spam and Velvetta sandwich, didn’t she? …..:

https://www.youtube.com/watch?v=C1Zp7vfyew8

( and Woodstock adds: “…. ‘cram pretend Spam’? …. ” )

The future is a factory town of scanty shacks. Just imagine driving down a street where most of the frontage is garages. These are not homes. They’re mini warehouses. Instead of this concept, how about a trailer park? Trailer homes vary some and can be specially situated on the lots for appeal. Couldn’t a trailer park be developed for less than half price? Wouldn’t a trailer park be an immediate answer to the housing shortage?

How the hell is this a good deal for the buyer if the only person saving any money is the developer? This makes zero sense. It should be the buyer getting the benefit of the TIF. This is a prime example of how TIFS should be outlawed.

No sh!t. The only benefit is cheaper homes, but as the developer said, that is NOT set in stone. If the developer signed a contract to promise and guarantee the base price thru 2026 I would applaud them for their effort. But nothing in this plan says they have to do it. I think Starr said it best, why not just wave the $2 million in infrastructure costs and be done? It is really is a Ponzi Scheme.

Good work on this!

Nothing about this says it will make the homes more affordable. The TIF business is out of control.

Neilsen construction is known for the lowest quality.

https://www.thedakotascout.com/p/the-dakota-scout-print-edition-783?utm_source=email

Very concerning that City Planning can’t articulate a cogent and accurate message on this (and TIFs, in general). The people handing out the candy don’t apparently even understand it.

JEckhoff is nothing but a Chamber Cheerleader.

[said in Clint Eastwood voice] “Will this project rob from Minnehaha County and the local school district property tax revenue for 20 years? Or only 15 years? Well, to tell you the truth, in all this excitement of counting building permit $s (the main job responsibility of a City Planning Director, don’t ya’ know), I’ve kind of forgotten myself.”

JEckhoff, probably.

Prove that Neilson Development is known for low quality, you better have facts to back you up prior to making such comments, cause that could get you into a lawsuit for slander or defamation. As for TIFS, I have always said, “LANDOWNERS” are the ‘vested owners’ of any sub-division, they are the ones who organized each other to establish a Township, a City, etc, they are the ones who invest in their LAND for one benefit, to pool their assets, in order to use those assets to build public roads, infrastructure, an electric grid, and a water and sewer system, all for the reason to establish a commercial hub – “A City”.

In the meantime, they allow commoners to come in, reside on their land, which of course also ‘adds’ value to their land, let alone, taxes collected from the residency, are then used to provide for expense of operating the “city”. The whole goal is to “add” value to the land, of which allows them to profit should they ever decide to dissolve the city, returning the land back to its natural sub-division, or township, or patent holder.

Says the last 4 people I know who toured and purchased new homes.

Slander, for having an opinion on a blog?….get a grip you child.