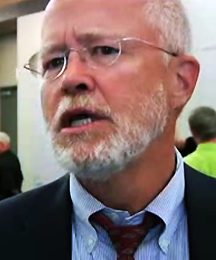

IMAGE: KDLT – Jeff Scherschligt, Managing Partner of Cherapa Place

I still shake my head and wonder how DT development helps me, or adds to my bottom line? We continue to be no different then Washington DC, we allow big business and development to take our tax dollars for THEIR benefit. Not ours.

Still wondering what constructing the tallest building in DTSF would accomplish? For me? A taxpaying citizen that contributes to this community. Bragging rights?

You want to develop on some dirty old RR tracks? Great. Buy it yourself, don’t allow taxpayers to be the broker.

Amen!

Mayor Mike’s has his head so far up this mans ass it would show on an X Ray. If you want to see the real face of corporate greed and the fuck the taxpayer attitude look no farther. He is the driving force to move the railroad to the south behind our homes, TIFS for all of downtown and free landscaping if your next to the river.

I and all of my neighbors hate you Jeff Scherschligt.

Harsh words, I Know. Very few deserve this kind of treatment, but this soulless ass does.

Really Us What You Really Feel…

Have known the Scherschligts since since grade school. Generations of investment in the city. When did you move here? Likely they were “here first” (see: your arguments about SON’s “rights”). What – beyond maybe borrowing money from a bank to buy a house – have you contributed to the growth and development of SF?

Generations of investment in the city

Ruf… You do understand the difference between an investment and a taxpayer funded handout….don’t you?

I have first hand knowledge that he was LIVID when the city turned down the plan to move switchyard operations to the south side of the city. He was handed the downtown property after the city knocked down the ZIP building. Was given tax incentives to build his dream, then threw a fit that the city refused to move the cho cho from beside the building that he just built.

READ CLOSELY RUFUX>>>He was LIVID that the city refused to move tracks from beside a building that he just built to behind the homes of the taxpayers he just got done screwing. Who was here first??? the railroad and the folks who built there homes on the south side.

He belongs in the cell next to BERNIE MADDOFF.

RUFUX… If you think this is “contributed to the growth and development” than you’re not much of a human being as well. So what is it that you are doing to better our (not your) city these days- NOTHING-You craft yourself as someone who has wisdom about our city but you don’t live here now,you have no skin in the game therefore your a paper hat and again your anecdotes mean shit.

For those of you who hate the “corrupt” Sioux Falls politics and the burden put on you as a taxpayer, I suggest you move to Detroit. They need more citizens.

http://www.forbes.com/places/sd/sioux-falls/

Better yet – of they truly want to experience a corrupt government run by and for an insular group of the self-appointed – move to any small town in SD.

What have I personally contributed to the growth and development of SF? Really? You have to ask that question? I have lived and worked in this city since 1991, and have always paid taxes and voted and only once I took advantage of a city program to fix my windows on my house. But no handouts, just a 2% interest rate. So I would say I have contributed quite a bit as an individual.

the tallest building in south dakota would be what, 8 stories tall?

This guy’s had a real sense of entitlement going all the way back to his 2005 TIF.

Yeah, but wasn’t Zip Feed already the tallest building in South Dakota before “Mickey Rooney” helped to knock it down? What gives? Well, I know Zip Feed didn’t want to give….

Meh… We freak out about a $35M (mostly federal) subsidy to get the East Bank railyard redeveloped, but nobody seems to be doing due diligence on the $100M+ being spent on the Hwy 100 loop, or the $30M+ to build a new interchange at 85th for Sanford’s new campus.

The fact is that downtown development gives the biggest bang for the buck. If done correctly, the railyard redevelopment could thousands of residents, jobs, and shops in a compact and efficient development pattern.

Whenever lots of people and activity occupy a little land in an efficient manner, it benefits all of us through a broader property tax base.

Unless, of course, you give all of that benefit away with a TIF…

Correct me if I’m wrong, but the area they are adding a line to the railroad in order to bypass cars is already a rail line. They even already own the land that the new line will sit upon.

So the argument rufus made about who was there first seems pretty relevant. If people are going to defend the “I was there first” line, they had better be prepared to apply it equally.

@ DL – I read rufus’ comment about growth and development as directed at LJL… not sure he was directing it at you (but rufus can clarify if need be). That said, it sounds like you are the typical taxpayer just like most of us. Living here, working here, paying our taxes and voting make us good citizens – but they don’t really change the landscape much. If you or I or thousands of other residents never lived in Sioux Falls the city wouldn’t really notice.

Like it or not, the big players in town are the ones who define the direction of Sioux Falls. They take risks and they put their own reputations (and bank accounts) on the line. Sometimes it pays off and people feel that gives them the right to call them greedy or corrupt or suggest they should be behind bars. Other times it doesn’t work and they find themselves bankrupt – both professionally and financially – yet we quickly forget the names of the big developers who are no longer making headlines.

Funny thing is, most people admit Sioux Falls is doing good things and is headed in the proper direction. Yet whenever one of these wealthy/connected/big names is associated with a major project that impacts a large area of Sioux Falls… these same people are quick to chastise them and call them names.

Whether the last name is Dunham, Lloyd, Scherschligt, Jans, Krabbenhoft, Ronning, or Van Buskirk the results are the same. People like the results of what they do… they just don’t like the way they do it.

As Aristotle has been quoted as saying, “To avoid criticism say nothing, do nothing, be nothing.â€

By the way, today’s StrongTowns post is so, so, so applicable to Sioux Falls.

Craig, how long have you been working for the Chamber?

Wow good one Winston… you really burned me there!

(sarcasm intended)

Now if you wish to disagree with one of the statements I’ve made, I’m more than willing to entertain a discussion.

Detroit Lewis: [posts blog entry about how everything sucks]

Commenter: Actually, I think that some things do not suck.

Other commenter: Screw you, you fuckin’ [communist/sell-out/out-of-towner]!

–every post on this blog, ever

How do you debate a corporate apologist?

“If you or I or thousands of other residents never lived in Sioux Falls the city wouldn’t really notice.”

maybe those in power should take notice, and quit trying to court the soccer moms and softball teams that come to town once a year, as if it is THEM who keep this town going.

Tom – I am a cynic. If you want to read all things positive about our city please go to KELO’s site.

@DL – I appreciate what you do on this site – just trying to make a little joke. As you said, you’re a cynic, which is something that Sioux Falls definitely lacks, but I do take an appropriate grain of salt when things get too negative here.

The joke was more meant to make fun of some of the polemicists and name-callers who make a frequent appearance in these comments.

KELO weather, however, can often be negative…..

You forgot to add the token comments that every penny should be spent downtown, and nothing anywhere else.

Winston: “How do you debate a corporate apologist?”

Well if you can’t think of a way… what does that say about your argument?

I find it ironic that somehow the most corrupt, closely held, over regulated city in the state – BY FAR (according to the anti-SFer’s here) continues to grow like gang-busters while the rest of the state’s cities struggle NOT to LOSE population – and the countryside turns into an expanse of 10-foot tall humanly modified grass (corn) devoid of almost nay humanity whatsoever.

If it’s so damned awful – why do thousands of folks continue to move to SF every year? ‘Splain that to me Lucy!

The Mayor stated in a Listening and Learning session that there will be NO residential development on the 10 acres that would be acquired with the 35 million dollar earmark for the railroad relocation project.

When asked about this, he did not clarify his response, but I am wondering if it might have something to do with the train noise.

At the final public meeting for this project I asked about the rail lines. The Mayor, Mark Cotter and Mike Cooper stated that 3 out of the 5 tracks will be removed and the same amount of train traffic that moved on the 5 lines will now travel through DT on the remaining two lines.

Craig, Oh, was I talking about you?…jk…..

Actually, it says a lot about my argument. A corporate apologist can potentially make a very logical point, but what if those points are not your values nor your priorities. Are we really on the same theoretical plain? And what if a corporate apologist consistently and blindly takes the corporate position, is it merely for argumentative sake or does it mean he or she cannot think outside of the box?

When the EC location debate was going, Jeff was planning on selling that land back to the City for the same SF price he paid for it years earlier to develop Cherapa, even though market value was at least double that amount once his building went up and he paid for the demolition of the Zip and the cleanup. He’s also put his money where his mouth has been a huge supporter of downtown & SF in general, mostly behind the scenes and without fanfare.

Jeff’s a visionary and a dreamer, along with being a hell of a businessman and philanthropist. In other words, he’s what most of you will never be..so hate away, he could give a crap what you think.

@ L3wis,

Many cities and towns that have seen their core areas go to shit are the places where urban sprawl is perpetuated as people & businesses flee to the burbs. This strains municipalities as they stretch their boundaries at a pace that’s faster then it would naturally develop. Every new mile of infrastructure is that much more expensive than the last one.

Downtown’s taxable property values have doubled in less than a decade, even with all those evil TIFs. So what a strong downtown offers is a solid and expanding tax base as properties are developed and re-developed. As more people move in, more businesses and services follow, which attracts more visitors and the cycle repeats.

Your current place of employment is a prime example. Had we stuck with the pedestrian mall, not done the Greenway and PTTF, and kept the loopers rolling around they would’ve likely shut down or never opened.

My bigger point is this all could have happened DT without taxpayer handouts, and you know it. It would have taken a little more investment from private developers (who are already worth millions), not to mention, isn’t that the whole basis of capitalism? Those who make smart investments are rewarded. Have things gone well DT? Sure. So why do I have to subsidize these millionaires?

Sy’s first paragraph is actually referencing “white flight” and not poor planning or development.

As far as the TIFs and development, not all TIFs are bad, but the “Good Citizens” of Sioux Falls should be on TIF Watch at all times.

In terms of the last paragraph, what does it really have to do with TIFs?

DL – do you take the deduction on your tax returns for your mortgage interest? If so – YOU my friend – are the recipient of a TIF (tax incentive to invest in property) from the feds Thank you all very much and good night.

I hear a lot of excuses from Winston, but no substance. I think he might be a politician.

Listen – if you disagree with something I’ve said then by all means say so. Tell me what you disagree with and why and we can have a discussion like adults. If, on the other hand, all you have to offer is name calling and platitudes, then apparently you really don’t have anything to offer and I’ll be done with you.

@Sy – I’ll admit there was a time I wasn’t fan of Scherschligt and I haven’t always agreed with him, but you do make some valid points that many of us have forgotten. Like for instance when he offered his property to the city for the same price he paid for it. Most ‘developers’ would demand above market pricing knowing the city was the potential buyer.

Granted he knew if the Events Center went downtown his building would increase in value significantly, so it was a wise business decision as well. That said, Scherschligt has been a consistent voice for downtown revitalization, and it was he alone who decided a former feed mill site would be a prime candidate for his new building. That was a gamble, but as as result that entire area is now being improved and we are starting to see a downtown that people are proud of again.

Do we have Scherschligt alone to thank for that? Obviously not – but he was one of the many who took a chance, and now on blogs like this one he is vilified merely because he happens to be successful. If you ask me – a lot of the blame and outrage placed upon people like Scherschligt, Lloyd, or Dunham is nothing other than jealousy and bitterness hiding under a cloak of anger.

Oh well – let the anti-everything circle jerk continue.

My mortgage interest deduction is a FEDERAL deduction, not a local deduction. But nice try Ruf.

I actually think rufus’s point has merit. You are taking advantage of a legal tax deduction which saves you money. There is no requirement you reinvest that money into your home, and chances are you could afford your home without it.

Now look at a TIF. The taxes on a property are still collected, but the taxes that would have been paid on the increased value of the project/development are instead redirected to site improvements, infrastructure, etc. So in theory, there are more requirements surrounding what they can do with their “deduction” than what you can do with a mortgage interest deduction.

Yes a TIF is a city issue and your deduction is Federal, but the end result is the same – tax money NOT being paid that benefits the party.

Same is true with your low interest loan for windows. You paid 2% interest, but that means the city was subsidizing your loan, because the city isn’t able to borrow money for 2%. So other taxpayers were actually helping you to install windows – but you won’t be caught complaining about a program that benefits yourself would you?

Now I’m assuming you are an upstanding citizen who actually paid his loan on time as intended, but what about those who didn’t? There are always a number of people who either can’t or won’t pay back their loans, which means the city has to enter into collections or liens and potential legal issues… all of which costs money – taxpayer money.

So you see DL – whether it is a program for homeowners to improve their property by installing new windows or adding insulation, or upgrading their heating and cooling systems or even replacing their toilets and washing machines – they are all programs that are funded by our tax dollars. They are tax rebates by any other name just as TIFs are. The only difference is TIFs are much larger in scale with more restrictions on what the funds are used for.

We all agree that not every TIF is justified, but if you are going to complain about people taking tax dollars for their benefit then you better be willing to look at the entire picture, because last I checked your new windows don’t really help anyone’s “bottom line” other than your own.

@ Winston, poor planning and development = your neighborhood turning to shit = white flight.

And it isn’t simply white people, anyone with the means to move their home or business from a bad location will do so. Subsequently and as we’ve seen of late in downtown in particular, you make some improvements and people will move back.

And sorry if you missed it, but where L3wis currently works is located on Phillips Ave, which has seen a revitalization and other places who were there before the revitalization are long gone with the exception of Minerva’s.

@ Craig Jeff also has maintained all along that he and his partners would make significantly more money on Cherapa over the long term had the EC not gone in and he develops out the property to a multi-story, mixed use building as he’s planning now.

So besides making nothing (actually a loss when you figure in demo and time value of $$) on the site he would’ve only been able to develop the retail/office along the riverfront had the EC gone in, now he can do that along with a big new private building where the EC should’ve gone. So he was out publicly lobbying for a much lower ROI because he knew it would’ve been the best investment for the Community.

Whatever he got back in TIF $$ is peanuts in the grand scheme.

@ L3wis, sure downtown might’ve grown the same without TIF’s, but at best it would’ve taken another decade or more. I think people lose sight of how abused that area was from the 1800s up until recently. We dumped millions of $$ into the failed pedestrian mall when we should’ve been using that $$ to clear out the industrial users and re-hab some of the old building that we hastily tore down. The quick & easy path (ie least resistance) for both the City and investment dollars was to ignore it and build another beige strip mall next to another mostly beige housing development on the edge of town. It took people like Jeff to say “Screw that, here’s what you can do”

Craig, I can see your point, but as I see it, TIFs are really hurting the county and they should have a say in it. As for my tax deduction and community development loan, that is funded by the Feds and doesn’t affect the county or the school districts bottom line. When you take money away from public services so a developer can re-invest in their property how does that re-investment help the community as a whole. Most times the developer will resell the property before the TIF ends passing the higher taxes onto the next owner. Just look at what Dunham did with the TIF on the COSTCO property. I see TIFs in this community as a way developers are making $$$ off of redevelopment. I still go back to my original argument that developers would still be making money without tifs, just not as much. I also wonder how banks determine their lending to developers if they have TIFs. Remember the Lloyd TIF that required him to have first floor retail, then he had it changed because the bank told him they wouldn’t loan unless he made it all residential.

And let’s tie this all in with the story in the AL today about the YMCA closing their pool DT to build apartments. I’m sure one of the main reasons the Y decided to do this is because operating an indoor pool is never a money making operation. This will just give the city another reason to build an indoor pool unfortunately. Pass the cost of this ‘needed’ pool unto taxpayers while the Y makes money from apartments.

So… you’re saying we should have subsidized the Y swimming pool? CONFUSED

Sorry, I wondered if that would be confusing. What I am saying is that the Y realized maintaining an indoor pool wasn’t feasible for them anymore, because it is expensive.

If maintaining an indoor pool is so expensive why have so many hotels added them or added on to theirs in recent years?

Sorry, but the Y has had numerous problems, which has led to the declining enrollment and has forced their downsizing.

Also, government functions need not always be subject to the same profitability requirements as private businesses.

DL: “I can see your point, but as I see it, TIFs are really hurting the county and they should have a say in it.”

I’m always curious about how the county doesn’t get a say in tax matters that directly impact them. Seems odd to me. It would be like the county telling certain landowners that they don’t need to collect city sales taxes. So I see your point there.

On the other hand, the County Commissioners have been very supportive of these TIFs, and for good reason. For starters it prevents urban sprawl which decreases the cost of infrastructure that the county might need to fund. It increases population density which is a good thing for all levels of government. They also redevelop property which not only raises the tax base of that particular property, but lifts property tax levels of property around it.

For instance, those strip malls near Costco? They just became much more valuable. The land that Empire Car Wash sits upon? It is now so valuable, that rumor has it he is selling it because the offer is too good to pass up. The end result is more tax revenue for the county with no increased expense on their part. Pretty hard for them to complain about a deal like that – and once the TIF runs out they get a substantial increase in taxes on the original property.

DL: “As for my tax deduction and community development loan, that is funded by the Feds and doesn’t affect the county or the school districts bottom line.”

I hear you, but the principle is the same. It is still essentially a net benefit to you at the expense of other taxpayers. The city and county have their own programs that benefit homeowners (low interest loans, redevelopment programs, facade improvement funds, rebate programs for new toilets, washing machines, and irrigation controllers etc.), but even if we are only talking federal programs it still is the same result, you are getting a benefit that helps you, and others pay for it.

Not much different from a TIF is it?

Sy on 08.20.13 at 2:01 pm

If maintaining an indoor pool is so expensive why have so many hotels added them or added on to theirs in recent years?

Sorry, but the Y has had numerous problems, which has led to the declining enrollment and has forced their downsizing.

OPERATING COSTS of a PUBLIC indoor pool:

Annual Attendance

80,104

2013: $692,729

2014: $710,168

2015: $728,152

2016: $746,699

2017: $765,824

To illustrate, the cost of a new neighborhood park is $300,000 to $500,000 including land acquisition.

Source for previous post:

Citywide Aquatic Facility Master Plan page 38

Who owns the strip malls across from Costco? Oh yeah, Dunham. Boy, he sure for a lot of use out of that one set of blue prints, didn’t he.

So – the valuation of Dunham’s strip malls go up – hos taxes on them go up – he subsidizes his own TIF across the street. Imagine that.

First of all, operating costs don’t tell even half the story until you factor in what Spellerberg currently costs the City as the oldest/worst pool we have then add in the projected new revenues it could generate whether that’s from passes or rent or whatever else they can come up with to increase usage. Also, with some smart design they could use a combination of passive solar/geothermal and those numbers would drop 100K on the heating/cooling expense alone, sure it would add initial costs, but they would be recouped within a 5-10 year span. Final point, with the Y closing their pool those attendance projections go from conservative to laughably low.

Sy,

Here are the projected REVENUE numbers straight from the consultant’s report. Are you now saying we can’t believe the study this nationally recognized firm provided us?

Page 28: This is the scenario the consultant has recommended:

Option 5: Large Indoor 50 meter by 25 yard competition pool with springboard diving and a separate 3,750 sq. ft. indoor leisure pool with current channel, and waterslide.

Page 38:

Large Indoor

Project Cost $18,519,000 (this has increased to 19.4m per Director of Parks and Rec, Don Kearney-Council Work Session, July 17, 2013)

Attendance

80,104

2013: Revenue 355,823 Expense 1,048,552

Operating Cashflow -$692,729

2014: Revenue 364,598 Expense 1,074,766

Operating Cashflow -$710,168

2015: Revenue 373,483 Expense 1,101,635

Operating Cashflow -$728,152

2016: Revenue 382,477 Expense 1,129,176

Operating Cashflow -$746,699

2017: Revenue 391,582 Expense 1,157,405

Operating Cashflow -$765,824

The story is in the numbers!

Once again we play ideas with numbers. The Spellerberg indoor pool idea never will come up to the numbers to prove it to be a winnable combination for the this little town. cr is correct to point this out but as numbers are placed on the table, other rationals are expressed with disappointing speed.

Sy: “Final point, with the Y closing their pool those attendance projections go from conservative to laughably low.”

Not so fast Sy – we are told people don’t use the Y pool because it is too expensive to have a membership and it isn’t convenient, thus the ‘need’ to have a city owned pool.

I think the consultants are pretty good at what they do – and if they say the attendance will be around 80k, that they are probably pretty close.

Since nobody expects users to pay $13 every time they visit the indoor pool, this thing is going to be a major expense to all taxpayers while benefiting a select few.

$2,000 of taxpayer money each and every day just so little Johnny can swim in December? I’m still not convinced.

I’m saying the game has changed since those projections were made, and will likely change again by the time of the vote and/or start.

Either way, what are we talking about? The price of a Starbucks Latte per citizen per year assuming they can’t find a way to absorb it? In the scope of our Budget and growth projections this project is certainly doable and definitely a worthwhile addition to an existing City park.

@ Craig, the Y membership isn’t too expensive and their swim lessons fill up very quickly, I know this firsthand as that’s where my kids have gone.

The building is ancient and probably as inefficient in both design and systems as you can find. With more private options for fitness and sports being introduced in the market as of late they simply couldn’t retain the number of members needed to break even. The pool is busy, and Embe next door has offered to share, but their pool is busy too so they don’t have near the time slots available to cover the demand and still serve their members.

I don’t care if it costs me a Starbucks Latte or a COSTCO cart full of Folgers coffee. Bad location. This should either be done in partnership with the school district or in partnership with Sanford. A stand alone public indoor pool makes ZERO sense, the only thing it will guarantee is that we will be subsidizing the crap out of it.

It’s not a bad location if you understand the demographics of the project and the neighborhood, plus we already own it. Like I’ve said before, put it on the edge of town and you’ll add millions to the cost and you still need to fix or redo Spellerberg.

If Sioux Falls had decent transit service, it would be hard to find a better location near two streets which should have frequent service (26th and Western).

To your point Tom — here’s one idea for what transit ought to look like in FSD. It’s probably not a perfect proposal, but it looks better than the current system.

https://m.neighborland.com/cities/sioux-falls

Nice! I agree, just designating a simple set of routes as primary or trunk routes (10-20 min frequencies) would be great. Seems like nothing in the SAM network is faster than ~30 minute frequencies.

I’ll put my (admittedly ambitious) plan for a Sioux Fall streetcar network here:

http://goo.gl/maps/MAbq0

Convert these to high-frequency bus routes and you’d have the beginnings of a usable system.

This one is probably a little easier to read.

A partnership with the school district or Sanford would save us millions, Sy.

Sure it would, but that shouldn’t necessarily be the deciding factor on whether or not a project is worth doing. Lots of partnerships are formed after the fact or even years later, like the YW and Avera for example.

Sy on 08.21.13 at 9:11 am

I’m saying the game has changed since those projections were made, and will likely change again by the time of the vote and/or start.

Either way, what are we talking about? The price of a Starbucks Latte per citizen per year assuming they can’t find a way to absorb it? In the scope of our Budget and growth projections this project is certainly doable and definitely a worthwhile addition to an existing City park.

Really, Sy……

So, now since the consultant’s capital and operating numbers aren’t quite working for you…….

And, most definitely will not work for Sioux Falls taxpayers, you’re saying the game has changed in the last four months since the consultants delivered their report.

Your statement has no credibility, unless of course you know something the rest of us don’t!

For more than 40 years, Counsilman Hunsaker (the consultant on this project) has led the industry by completing more than 850 national and international aquatic projects of every size and complexity. And you are telling us you understand the number projections better than they do!!??!

The facts are:

CAPITAL COST of public indoor pool:

19.4 million dollars (this number has already increased by $900,000 in just the four months since the consultant presented the cost as $18.4m)

OPERATING COSTS of a public indoor pool:

The projected operating costs over the FIRST FIVE YEARS are $3,643,572.

To illustrate that number: the operating costs for the first five years only is the equivalent of providing our community with SEVEN new neighborhood parks!

I believe SF voters (taxpayers) will be looking closely at these numbers.

correction to previous comment:

CAPITAL COST of public indoor pool:

19.4 million dollars (this number has already increased by $900,000 in just the four months since the consultant presented the cost as $18.4m)

**that should read $18.5m, not $18.4m

Sy: “@ Craig, the Y membership isn’t too expensive and their swim lessons fill up very quickly, I know this firsthand as that’s where my kids have gone.”

We have been told one of the reasons we need an indoor pool is because the private pools are too expensive. Now you are suggesting they aren’t – just in time for a wrecking ball to tear out the Y pool.

I’ll stop for a moment so you can decide which side of this issue you really want to be on.

Back in the real world, one might think if the demand for swimming was so great, that the Y might actually be able to keep their pool operating at full capacity. Yet they obviously can’t make it work because they don’t get government subsidies to keep their doors open.

Heck I think Sioux Falls should have a city owned and subsidized indoor golf dome, because people need to play golf in December too. Don’t tell me it is a summer-only activity either, because that argument apparently doesn’t work for winter. Don’t tell me we already have a private indoor golf dome – because apparently that argument won’t work for pools either.

Yes I’m being a sarcastic bastard here – but honestly does the city really need to provide everything for everyone? If the demand for indoor swimming isn’t great enough to keep a private pool in the black, why should the city fund one? Shouldn’t we focus our tax dollars on where they have the greatest impact? As cr points out, we could build a LOT of city parks for the cost of operating one pool, and which do you think is going to get more usage by the citizens?

“If the demand for indoor swimming isn’t great enough to keep a private pool in the black, why should the city fund one?”

AMEN!

@ cr I’m saying that their report was based on their analysis from 2012, when there was no indication the Y would close it’s pool.

It also shows that when Drake went from a crappy, old rectangle outdoor pool (like modern day Spellerberg) to what it is now, the usage increased 400%, and that’s based on 70-80 average days in operation. The neighborhood population didn’t increase even close to that, so that tells you neighborhood kids used it more and people also travelled from other areas to use it. The large, indoor aquatics center won’t have quite as many bells and whistles as the new Drake pool, but I still think with the new amenities coupled with the 50M (which we don’t have) and year round use along with the Y’s closing you will likely see that usage number increase closer to 100K, making it the most heavily used pool in the system by far.

But, hey if you think the consultants word is gospel, than you must agree with their recommendation to do the plan now and the City can easily handle it, right?

rufusx on 08.20.13 at 8:16 pm

So – the valuation of Dunham’s strip malls go up – hos taxes on them go up – he subsidizes his own TIF across the street. Imagine that.””

Just take a moment to think about how stupid that is. Again, you have no idea how taxes are accessed do you. I absolutely undoubtedly will bet you that the taxes of the strip mall will not increase with Costco across the street.

Sir, your neighbor just put in a pool so we are going to have to increase your taxes as well.