UPDATE II: I went and talked to the equalization department today. After reviewing the increase, they explained to me that 90% of the increase is land value, in which is formulated different now. We also calculated that my taxes will probably go up $250 dollars next year, which is NOT $2 a month, just for the record.

UPDATE: I decided to go back and look at the records I could find

From 2008-2009 the value of my home went up 1.8%

From 2009-2012 the value of my home went up 0%

From 2012-2016 the value of my home went up 10% (aprox 2.5% per year)

From 2016-2017 the value of my home went up 1.8%

From 2017-2018 the value of my home went up 1.8%

From 2018-2019 the value of my home went up 2.3%

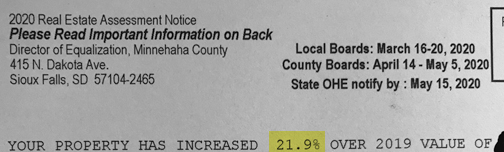

From 2019-2020 the value of my home went up 21.9%

As I predicted and warned people, the school bond, the new county jail and the multiple TIFs we hand out are going to catch up with us. The $2 a month boloney they pitched us was a farce, because I knew they were going to make hay with the assessments. And sure enough they did.

My increased assessments year after year have been steady, but reasonable. I have owned my home for 17+ years and my property taxes have doubled in that time.

I have done little upgrades to my home, except replacing windows, doors, adding new rain gutters a privacy fence and re-shingling after storm damage. I have done NO upgrades to the interior of my house.

So imagine my surprise when I got this in the mail yesterday;

Well, I was NOT surprised, I saw this coming like a freight train. We can’t keep borrowing money in Sioux Falls and not have a way to pay those bonds, so they bleed it out of us through back door tricks like assessments. Can I afford a 21.9% increase in my assessed value? I suppose, but it also means a lot less money in my pocket.

It was interesting listening to the State Legislators talk yesterday at the legislative coffee about state funding of education. Two Republicans made great points;

• The state gives the districts money and the districts decide how that money is spent (salaries, etc.).

• Administrator pay in SD ranks at 15th while teacher pay is at 49th. I haven’t checked that stat, but I know at one time in was around 22nd. There is a obvious disparity.

• Low voter turnout at school elections. The past school bond and school board elections both had around a 4% turnout. Basically the legislator was saying, if you want to have a say on how your local district is being funded, maybe you should show up and vote in these elections. AMEN Brother! But I also have to add their is voter suppression when you use super precincts, no precincts in the northern part of our city and have district finance department employees ‘hand count’ votes, while the business director puts those counts into the system without oversight.

Who knew that owning a house that was built in 1889 could increase in value by almost 22% in one year? Not bad for a home that is 131 years old. What a joke.

There’s been substantial real estate appreciation in the city. The county is catching up but could have done it slower. Ongoing appreciation will be slow mostly because of the Ag economy in the state. What doesn’t get taken into account is the dollar is worth less and wages are stagnant. It’s getting hard to afford living in Sioux Falls.

It’s unfortunate Cynthia Mickelson and Marshall Selberg have no challengers.

People, look at your assessments, then decide if it’s worth 15 minutes of your time to go vote.

There will be absentee voting and April 14th the polls are open for 12 hours.

Mine went up 10.1% in one yr. It’s partially due to residential property values having gone up significantly since 2016.

It took for my home seven and a half years to recover the loss value of my home due to the Great Recession of 2007-09. But since 2016, my home has increased in value by 25%.

A mixture of opting-out and major residential property value increases in recent years has created a windfall for local political leaders, which they knew was happening, but have allowed it to happen to their benefit with no serious discussion of the latter, when promoting the opt-outs that were discussed and then approved.

Too often our discussions and debates involve around the budgest and how money is spent. It’s time that we start talking more about the revenue side of this issue, that is where the true smoke and mirrors of governmental budgeting comes into play.

Playing devil’s advocate how much has your assessed value increased in past five years

I doubt voting will matter. It’s been rigged before and low income doesn’t go to the polls. I suggest looking at living in outside suburbs where sales tax is 1% less and property valuations are affordable. Savings pay for the commute. There’s democratic government in places like Harrisburg and Tea. Schools are better. I’m retired and need a townhome with association maintenance. There’s some in Brandon but they’re dated. A builder that’s not part of federal programs and Sioux Falls corruption should consider building 10 miles out of town. It’s time.

Sioux Falls is becoming like Detroit, Baltimore, and Philadelphia. You need certain things once in awhile but it’s safer (low crime) and cheaper to live outside city limits. Your teens can come to town to score crack and cocaine but nobody should live here.

The property valuation calculated by the county should mirror market value. Would you sell your house for the value they set? If you could get that or more on a sale the value is fair (or possibly not high enough). If the market would not support that price then your property is over valued.

Matt’s right. It’s not a “trick” or a “scheme”. It’s a mathematical calculation based on a known data set from the real (pun intended) world.

While I agree the calculation is correct, I think we need the rate lowered. My property taxes are out of control and keeping going up. Mine have gone up 25% in 6 years and if we just stopped buying all this Sh!t it wouldnt be so high.

Option 1 – Lower property taxes half a percent, I think we can afford it

Option 2 – Lower property taxes half a percent and increase sales tax a penny

We keep kicking homeowners @sses to0 hard and this burden to pay for all this stuff, especially schools, needs to be more spread out and equitable. This is not to get into a debate about haves and have nots but, my tax burden is getting a little out of control and yes I am all in for helping everyone’s kids and future generations go to school but, this is getting ridiculous. This is why a sales tax is the most equitable solution and just get rid of property tax period (yes I know it will never happen).

Great! So not looking forward to getting another notice in the mail for our home. We just purchased it 3 yrs ago but every yr it has gone up even though the interior is all original since it was built in the 90s minus the carpet we pulled to replace with laminate as previous owner had cats and dogs.

What the city claims our house is valued at would not sell at as the house in our neigbbor that are/were selling at those rates are upgraded. Yet the city thinks they need a walk through of your home to make better determination *roll eyes*.

I have NEVER lived anywhere that has property assessments done very year and so sick of seeing the city “project cars” around.

This city screws us over so much that they need to start mailing taxpayers with notices.

WRONG>

If property were taxed based on market value, we’d be paying a lot more and tax collected would fluctuate wildly. Should we pay sales tax on full retail price or sales price?

Accessed value is based on value of the materials within.

Many things can change that value especially not having a real evaluation regularly. I would say budget shortfalls is certainly pushing evaluation towards the high side, and property tax SHOULD be immune to budget woes.

I know Minneha is about to sell a large chunk of mining land it’s been hoarding for quite some time.

Bingo. For 11 years my valuation basically increased at the rate of inflation, than, Whammo!

This has to do with paying for all the crap they bonded for, and me’s not happy.

Your missing my point. Here’s how to know if your accessed correctly. Would you sell your property for its accessed value? If you will, I’ll buy it.

Additionally, the economy and the housing boom has sharply increased materials and labor costs.

I will bet you see a stagnation in it’s accessed valuation over the next decade because it’s now on the high side of the scale. For right or wrong it’s a way to pull in the shortfalls in the near term .

As a general rule in the midwest and northern plains assessed valuations are about 80 to 90% of market value. Also in the plains states, property taxes per year run about 3/4 of a percent to 1 percent of market value. I sense SF is much higher than this, at least by my tax payment. How about you?

This is the administrative work we get from the 6-figure salary “best & brightest” lieutenants the mayor attempts to brainwash us into believing our municipality can’t do without. They can afford these taxes on their incomes. They figure everyone else should be able to, too.

If you haven’t yet watch the video below from the finance director from the SF school district regarding education funding.

Both Sales Tax and Property Tax on land can both go down 1% and we have enough money.

Look at the C.A.F.R reports and see how many ASSETS the government is purchasing and owns, Just a look at Sioux Falls C.A.F.R shows we own tons of assets. This town buys assets as if the PEOPLE so freely gives them up.

The CITY SALES TAX can be 1.75% and we be fine, the PROPERTY TAX can be lowered by 0.8% and we be fine. We are giving them to much revenue. Thats the problem.

Mike Zitterich

Exactly, Mike.

This city does NOT have a revenue problem but a MAJOR

spending problem. The city needs to stop buying and start saving and lowering taxes they steal from people to use towards things they shouldnt be using OUR $ for in the first place.