UPDATE III: Your Dream Home Awaits in Southwest Brandon

UPDATE III: I wanted to make a correction to some of the things being said about how the homeowners will be paying back the TIF. While I have surmised from Mr. Powers testimony last night that the repayment would go back to the developer, SF Simplified was told this from the city’s planning office;

The $2.14 million would help with the costs of getting the site ready for homes, designing, etc., and it’d be paid back to the city over the next 20 years via property taxes.

Which makes more sense since the city is footing the bill for the infrastructure, but it still puts into question what was said at the meeting last night.

Does the developer take on the $2 million in debt or the City? Is it a 15 or 20 year TIF? I’m not sure who is in charge of talking points for this project, but it gets more confusing by the day.

A city official told me today that the payback to the TIF will actually go to the bank who is giving the loan for the development, which makes sense. Oh, and guess who that bank is

UPDATE II: Finally! At the planning commission meeting tonight, commissioner Larry Luetke asks how the TIF works when it comes to the eventual purchaser. Planning staffer, Dustin Powers explained that as people purchase the homes they will have to pay their FULL property taxes then the county will pay part of those tax funds back to the developer until they hit the $2 million amount. In other words the developer is paying the full cost of the development and the homeowners will be paying back the developer thru their taxes over the next 15 years. So essentially, like Starr said last night, this is just a $2 million dollar break on the development itself, for the developer, and gives the eventual homeowner NO tax savings.

On top of that, there are NO guarantees the pricing will come in where they would like them to. The developer has already warned those prices could fluctuate (in other words go up) and there is no contractual agreement to keep the price where promised. Good for the developer, not so good for the homeowner.

*on a separate note, one of the newer commissioners called roads in a development ‘artillery roads’ instead of ‘arterial roads’. I’m not sure what an artillery road is, but if you drive around some central neighborhoods you can certainly see some streets that look like they got hit by artillery.

UPDATE: Tonight at the city council informational meeting they did a presentation on the TIF and it’s hard not to come to the conclusion that developer, not the future homeowner is benefitting from the TIF. Councilor Starr said it best when he suggested that maybe the city should just pay for the $2 million in TIF expenses (infrastructure) out of the general fund and not mess around with the TIF.

Either way, the half ass promise made from the administration, planning and the council before the last election is we were going to target affordable housing in our core, building density while cleaning up our central neighborhoods. Instead we got a ham and cheese sandwich made from Spam and Velveeta.

———-

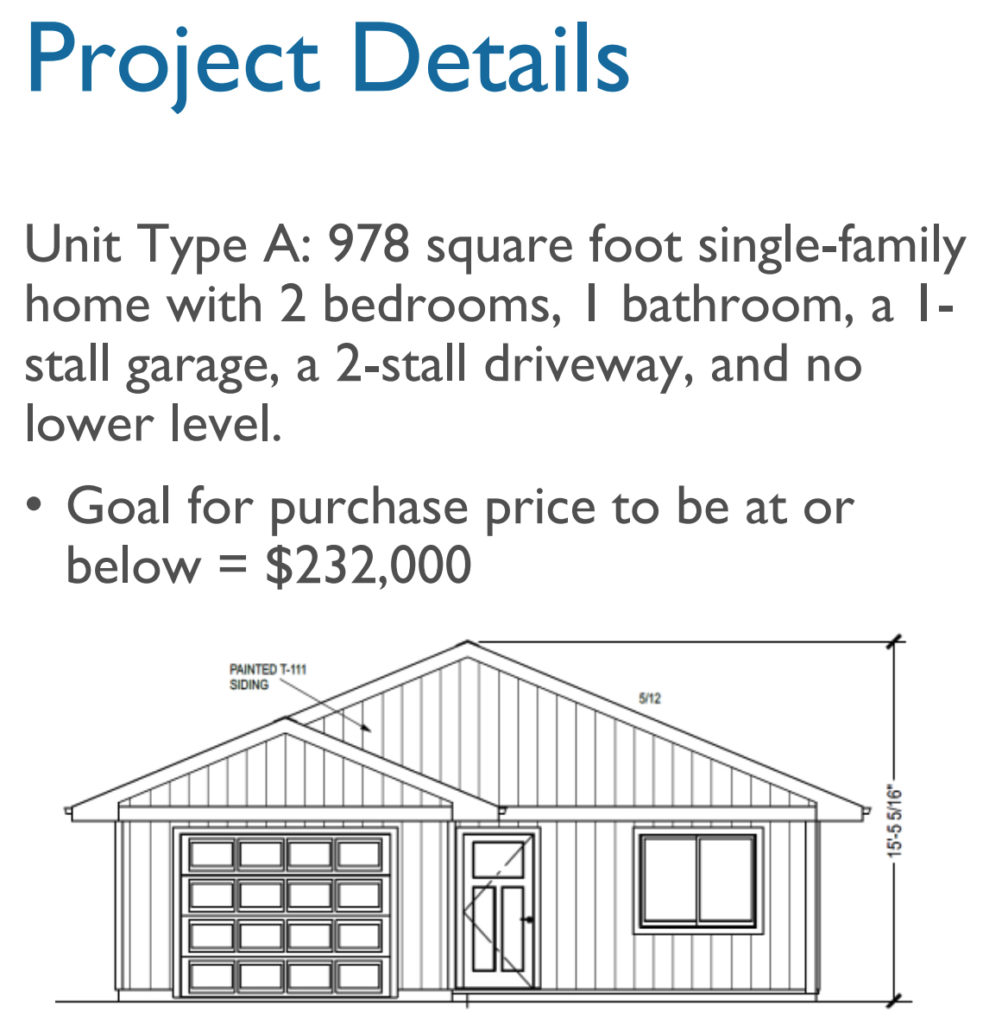

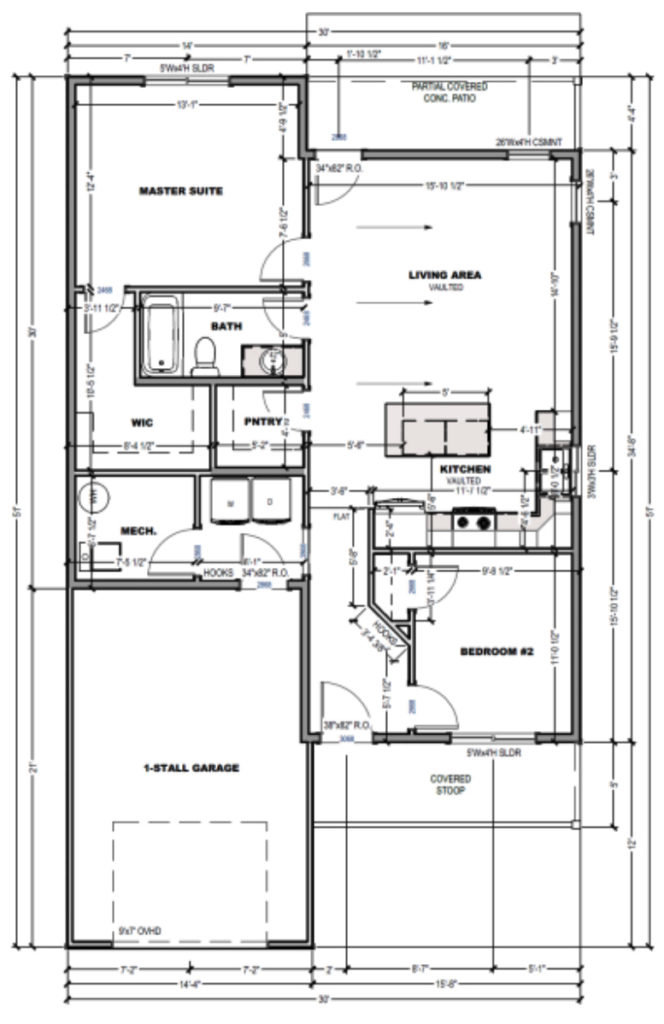

The Sioux Falls Planning Commission will be mulling over TIF #26 (Items 5C & D) this next Wednesday. As you can see from the drawings below these are pretty tiny houses. I was also surprised by the floor plan in which the bedrooms were not placed next to each other with one bedroom next to the front entry.

What is curious is there is NO mention in the agenda documents about who will be getting the 15 year tax break. The developer or the new homeowner? There is also the infamous recommendation from un-elected paid planning staff;

Both staff and the development team believe this amount of TIF support is appropriate and adequate for the project to move forward, and that without TIF in this amount, this project as presented would be unable to move forward.

The classic ‘We can’t do this without the TIF.’ But again, I ask, who will be getting the tax break? How do you give a 15 year tax break to a developer who will be selling the homes? Will the new owners be getting a 15 year tax break? I’m puzzled how this will work. It appears to me that the developer will be getting a $2 million dollar tax break up front and the new homeowner will have to pay the normal taxes.

Hopefully we will hear an explanation at the meeting.

*You will also notice that the planning agenda is NOT using the annotated agenda like the city council is using now. Not sure why transparency is so hard for these folks?