Are peeps shopping local? No.

I have been enjoying my almost weekly response to Jodi’s Journal. For full disclosure Jodi and I have a ‘news’ relationship. We talk when we see each other in public and we email frequently about things going on in the community and if you ever have a chance to speak with her in person, you are fortunate, because she is a loaded with information about our community, business and the economics of it all. So I found her article about shopping local intriguing, but the same old tired holiday journalism. I guess I am of the opinion that I would shop local if I could get what I wanted. I can’t. And most agree with me, just look at the latest financial report from the city;

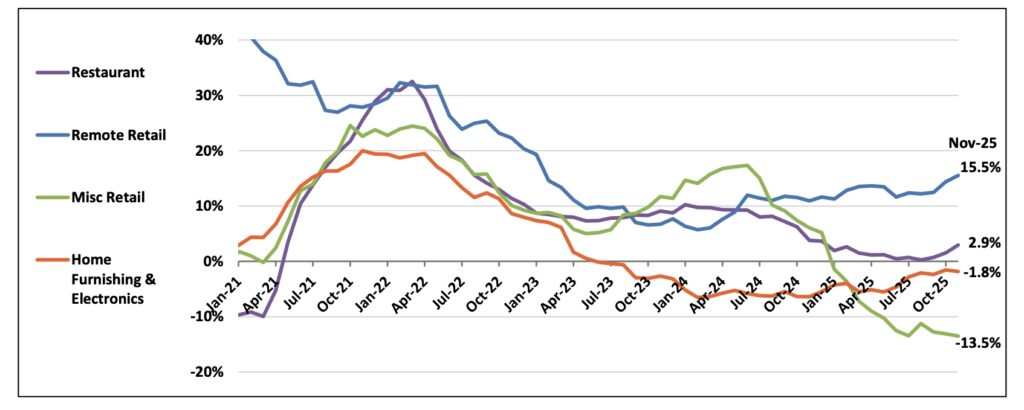

The only retail sales that have weathered the storm is online remote retail in Sioux Falls (which I am thankful for). If this part of sales tax collection was NOT this strong in town, we would be so under water right now, it would be silly.

So why is this? Like I said, finding certain products at local retailers is a challenge, but it is NOT just that. There is the convenience of online shopping, also the speed of delivery is insane. Had a friend recently order a gadget he needed from Amazon and it was in stock at the SF warehouse. He had the piece in 45 minutes. There is also the cost factor. I have bought stuff on Amazon (same quality and brand) for a third of the price of a local retailer.

This is plain and simple economics. People are going to find the best deal. And if I can buy a case of Ramen noodles for a third of the cost of buying the same product at HyVee, which will I choose?

I think local retailers should specialize in unique items you can only get here and stop chasing some Little House on the Prairie merchantile.

But the article gets more juicy when our mayor, who is apparently a Metro-Yeti (c) says this (when talking about participation at the new refrigerated ice rink);

The numbers are “good but not great,” TenHaken said. “And it’s South Dakota. We expect this.”

Well, we should expect it. We also maybe need to be a bit better at powering through it. I’ll acknowledge it’s more convenient for me to sit inside, do phone interviews and write on days like we’ve had lately. But I also criss-crossed the town several times on our snowier days recently and was reminded it’s really not that difficult to go about the day more or less like normal.

“I grew up in Minnesota, and Minnesota learned to embrace winter. It’s in their culture. It’s in their DNA,” TenHaken added. “They have snow vests and Surly Brewing tasting events out in the snow. I think Jacobson Plaza is our first attempt to really embrace winter, and we need to go outside in the winter, whether it’s Great Bear or Jacobson Plaza or the downtown Holiday Plaza. You don’t have to stay inside.”

I know it is rare, but I agree with Paul 1,000%! When it comes to outdoor winter rec in Sux, peeps are gigantic p……………..!!!! GRAND CANYON SIZED!!!!

But, knowing that, why would you dump $16 million into a facility that would rarely get used? I think an indoor/outdoor ice facility would have been a better route and you could have ditched the playground, piss park, dog toilet and hamburger shop for a facility that people would actually use. But that takes vision. Doesn’t it?

The ‘Shop Local’ mantra makes me chuckle, because there is only a handful of developer welfare queens that run this town while stealing your money and making your lives miserable with low wages and crappy taxpayer services.

When I hear the mayor, any mayor, say ‘Shop Local’ in Sioux Falls, I just feel like saying, ‘DUH’ then look for my Amazon login.