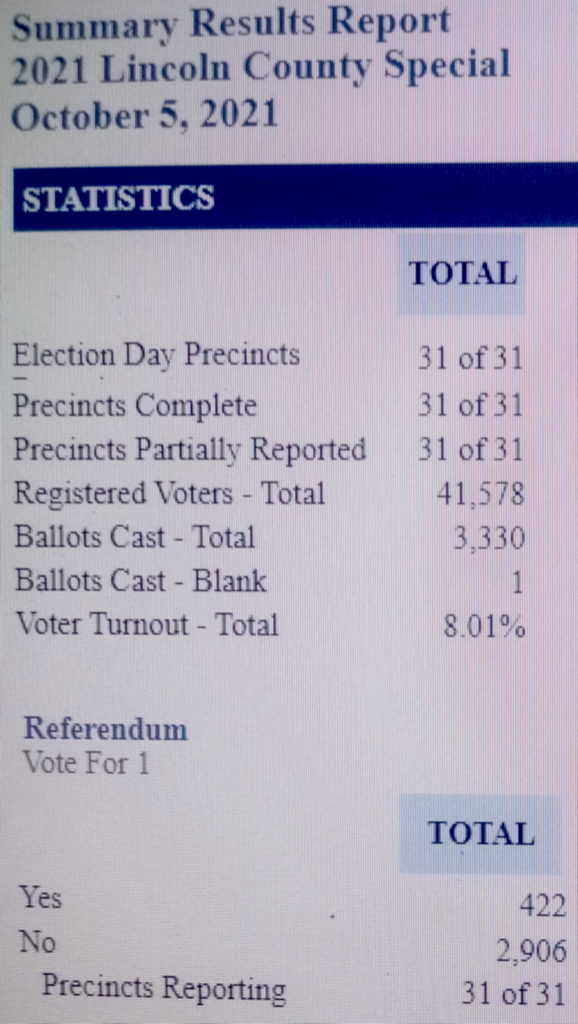

I do agree that it was only an 8% voter turnout, but either way, it was a blowout. I have felt for a long time that both County Commissions, the City Council and the School Board are NOT listening to what the citizens want, or in this case, don’t want. They simply show up and vote for tax increases on the minions so they can turn around and give contracts or tax breaks to the welfare queen developers, banksters and bonders.

The system is rigged.

We no longer have representative government in the Sioux Falls Metro Area or even in the state. This is what happens when you have one-party rule by authoritarians who only serve the ruling class. Don’t believe me? A majority of all of the members of all of these governing bodies are Republican. I think the only members that are registered Democrat are Pat Starr, Jeff Barth and Kate Parker (there may be a couple more, but they ain’t telling anyone.)

The irony of the Tax Levy revolt is that it was spearheaded by Republican voters! That is why it still baffles me they continue to vote for the very representatives that don’t listen to them.

I told an older Democrat not to long ago that no matter who the majority party in local government bodies is, you will continue to get tax and fee increases. The difference is the Dems will spend it on the citizens and the Repugs will spend it on their welfare queen developer bankster buddies.