UPDATE: Using Entertainment taxes for private entity setting a bad precedent

I first want to say I support finishing the State Theatre, I have actually helped with some charity fundraisers for the facility through ZombieWalk and SF Roller Dollz. I think it is a worthy cause and I applaud Denny Sanford for giving money to the goal of completion. But I think that is still the direction the theatre should move in, private donations for a private facility.

Using entertainment taxes sets a bad precedent, as I pointed out yesterday, and I will tell you why.

Seven years ago, former city clerk Debra Owen won an open meetings case over how her termination was handled. During the proceedings, City Attorney David Fiddle-Faddle argued his case based on the opinion of a former attorney general. 4 of the 5 attorneys who sat on the Open Meetings Commission contended that an ‘opinion’ of an AG is NOT case law, so it did not apply. When Fiddle continued to argue based on the AG’s opinion, one of the panelists asked David cynically, “You do understand that the opinion of a AG is not the same as case law? Don’t you?” The crowd in attendance let out an audible giggle. The commission determined that you have to base your arguments on tried case law, not opinions.

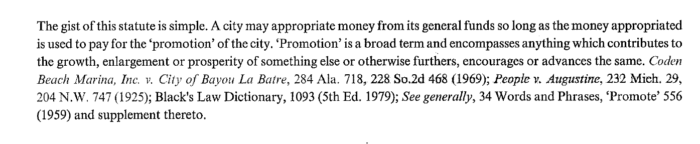

The City of Sioux Falls is trying to say they can spend the entertainment money on a private entity in the form of promoting the city based on a opinion of the AG in 1984. But there is NO case law. In other words, the city could be sued if they try to set this precedent. Even if I supported giving the State Theatre MORE tax money, which I don’t, it should come out of the CIP not the entertainment tax.

Listen to Allison Weiland talk about the State on Jon Michael’s Forum

In other news, Cameraman Bruce attended a luncheon today talking about open meeting laws, 3 of the panelists were former State Legislator Dave Knudson, Argus reporter Jonathan Ellis and Jon Arneson (Argus attorney). They all contended that the most recent open meeting laws that Knudson helped write, said that if text messaging or emails during a public open meeting are being used, that correspondence can be used in a court case. So council, if you were smart, you would put the phones and email chatting away during the meetings.